Random question but my work pension got moved into a LIRA (Locked-In Retirement Account).

Is that considered to be an RRSP and declarable when you do taxes?

Random question but my work pension got moved into a LIRA (Locked-In Retirement Account).

Is that considered to be an RRSP and declarable when you do taxes?

Stay the hell away from low volume ETFs. The biggest problem is that they could get dissolved.Originally posted by NoXcuses

As a newbie investor, I seem to shy away from stocks/ETF's that are low volume. I see that CWW.TO average volume is about 3,923(M).

https://ca.finance.yahoo.com/q?s=CWW.TO&ql=0

Is my thought process misplaced? I figured that with low volume stocks, any upswings or movement would be few and far between. I suppose this is the LT thread, so in this case the time horizon is 2-3 years and greater.

I'll say it again, you guys want an incredible company to invest in look no further then PPL.TO

Currently trading at $29.72 with a 15.25cent per share dividend, a yield of 5.87percent, it's easy money.

This company will be trading at $60 by the end of 2017. Get in now while it's reasonably affordable.

That's a chump return bhads. Crescent point is currently trading at $13.66 pays 10cent dividend per share, a yield of 8.64% and will be trading at $60 by 2017...Originally posted by 89coupe

I'll say it again, you guys want an incredible company to invest in look no further then PPL.TO

Currently trading at $29.72 with a 15.25cent per share dividend, a yield of 5.87percent, it's easy money.

This company will be trading at $60 by the end of 2017. Get in now while it's reasonably affordable.

I wouldn't be touching any producers right now. But hey, each to their own.Originally posted by BavarianBeast

That's a chump return bhads. Crescent point is currently trading at $13.66 pays 10cent dividend per share, a yield of 8.64% and will be trading at $60 by 2017...

Let's see who's prediction comes true

I was only kidding, implying that practically any legitimate company right now that has been hit hard by the price of oil will be worth a lot more in the coming years.. (We hope)

I hold some Pembina, but I think there is an ocean of good buys right now.

I agree, but I'm shying away from producers, oil prices are not looking good anytime soon. Wait till 4th quarter results are published, then you will really see shit hit the fan.Originally posted by BavarianBeast

I was only kidding, implying that practically any legitimate company right now that has been hit hard by the price of oil will be worth a lot more in the coming years.. (We hope)

I hold some Pembina, but I think there is an ocean of good buys right now.

Risk tolerance.Originally posted by 89coupe

I agree, but I'm shying away from producers, oil prices are not looking good anytime soon. Wait till 4th quarter results are published, then you will really see shit hit the fan.

Midstreams are cheap but producers are cheaper. I fully suspect shitty q4 results are baked into stock prices already.

I'd still shy away from producers until oil makes a meaningful bottom, but I wouldn't write them off.

I sold all my midstreams end of December and will look to invest it back in at a later date (most likely March).

Alright kiddies, who was smart enough to have cash on the sidelines, and is now buying back into energy assets?

I rode this one all the way down, and I'm still holding, so I'm not counting myself as smart.

This quote is hidden because you are ignoring this member. Show Quote

Pretty much this. Since this is the "long-term" thread, just been holding on to my energy/service side stocks. Wouldn't call "hold and pray to God they recover" a sound investment strategy (as a matter of fact, many would say to sell and re-deploy that capital into something else), but I never said I was a smart investorOriginally posted by ExtraSlow

Alright kiddies, who was smart enough to have cash on the sidelines, and is now buying back into energy assets?

I rode this one all the way down, and I'm still holding, so I'm not counting myself as smart.

Do have some spare change laying around that I've been thinking to buy back into on the energy side, but I feel I'm already overexposed, soo not sure.

Takes balls to buy into something that has already crashed but that's what you have to do. '08 crash was most brutal on the financial sector but it was also the best time to get in. I would say energy is a bit different in that renewable energy is starting to emerge as an alternative to crude oil. Banking will always be there. I think oil will recover eventually because things just don't change that fast. Sure there's a lot of EV talk out there but it'll be decades before we're all driving one.

I have $18K. Pick me three stocks. Doesn't matter if Canadian or US.

edit: not the purpose of the thread

Last edited by dirtsniffer; 02-19-2017 at 04:31 PM.

good opportunity to pick up some TD stocks on sale as a result of the news this morning

-4.7% right now

-5.75% when I picked up a position... see if it drops anymore later (or Monday).Originally posted by secol

-4.7% right now

yeah. in the end if you're long a dip like this is a pretty good opportunity to buy if you didn't before. it's like a 3 month rollback

Honestly I am hoping that the media coverage only gets more intense on Monday and that it drops another few points.Originally posted by secol

yeah. in the end if you're long a dip like this is a pretty good opportunity to buy if you didn't before. it's like a 3 month rollback

I will happily liquidate a few sluggish holdings to buy more TD stock at 7-10% under its market value.

At the end of the day this scandal will not hurt their balance sheet enough to justify the stock price dropping this hard.

Public perception is reality sometimes. TD will need to adjust their sales tactics/policies accordingly and that could easily lead to lower sales. I don't know what % of their bottom line is service charges and CCs but their profits could certainly take a hit.

For Chemistry geeks. Calcium - 48 now on sale!

But I still think Nickel 61 has more investment potential.

http://www.buyisotope.com/nickel_iso...0_61_62_64.php

Cocoa $11,000 per tonne.

So recently my company started offering RRSP's in addition to our pension.

While the pension is very good, considering I am quite young and it is bound to be changed at the whim of the government, I'd still like additional funds invested somewhere.

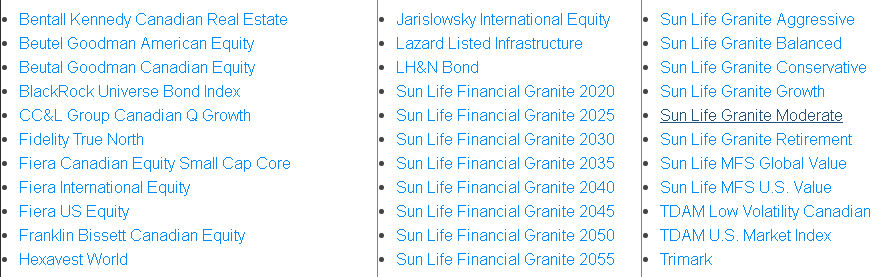

We've been given the choice of these funds (managed through sunlife as a group policy) to put into RRSP's.

Would these funds even be worth putting money in? I figure I would like to be in a more aggressive fund, but other than that, I really don't know. Never bothered looking into stocks/investments much as real estate plus the business has been where I've tried to put my money. It's unclear if the company will do any contribution matching, if it does, it makes it a lot more appealing to invest.

Thoughts? I know nothing about stocks/rrsps/investing besides following some businesses to stay abreast of news coverage and whats going on worldwide.