I don't know about the odds or the value, but I have the statement for my odyssey right in front of me. I have collision on it and it was $255/yr at the last renewal.

I don't know about the odds or the value, but I have the statement for my odyssey right in front of me. I have collision on it and it was $255/yr at the last renewal.

This quote is hidden because you are ignoring this member. Show Quote

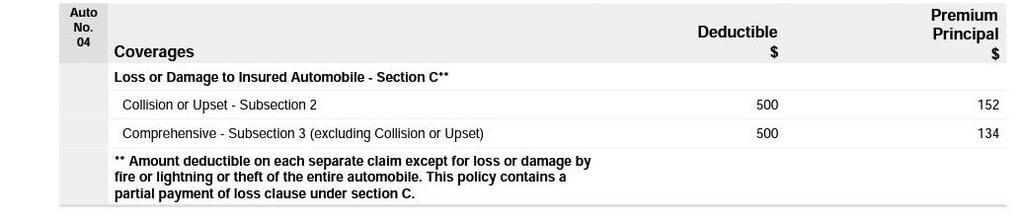

Once again, I'm proven a liar. It's $152

Just to add a few thoughts to the thread:

- I'm not nearly as biased on this subject as some of you may assume, yes I make my living in insurance but I'm a bigger proponent of prudent personal finances.

- Collision takes care of not only repairs to your vehicle in at-fault scenarios but also hit & run, hit by an impaired driver, hit by a stolen vehicle or hit by someone in medical distress.

- If you don't have collision coverage and you're involved in a not at fault scenario then usually your insurance company doesn't help you deal with things, you're left to negotiate with the other insurance company directly. IN THEORY this shouldn't matter but I can tell you more often than not it absolutely does.

- The true calculation should be the cost of the premium plus the deductible versus the current market value of the vehicle plus another $1000ish for towing / storage / disposal. There's no right or wrong answer here, it's all about what you're comfortable with financially. Can you afford to throw that car in the garbage, replace it with cash and not have it impact your day to day finances? If the answer is no then the prudent financial move is to carry the insurance.

"Masked Bandit is a gateway drug for frugal spending." - Unknown303

I'm glad you brought that up because I knew there were a couple other things that made it a benefit that were counter intuitive.This quote is hidden because you are ignoring this member. Show Quote

Not having to deal with the other parties insurance is definitely a big plus, and almost worth $150 a year in itself. Unless you enjoy arguing with someone over the phone and getting almost nowhere. Just trying to argue with my own insurance over the replacement value of my Jetta was painful enough, and it wasn't costing them a dime.

My parents had a hit & run on a car they paid collision on. Witnesses noted the offending car. Without paying the deductible, Insurance was unwilling to pay anything for 3 months while they "investigated", even though at a month in we had correspondence with CPS that the offending vehicle's owner was not answering the door, phone calls, and pretty much actively avoiding the police. Only finally resolved when someone somewhere somehow admitted fault.This quote is hidden because you are ignoring this member. Show Quote

Does there exist a $0 deductible policy where I can just get my shit done while insurance goes figure out their shit? Or am I just a horrible negotiator.

Because you didn't pay the deductible. Why on earth would you do that to yourself?!This quote is hidden because you are ignoring this member. Show Quote

You joke, but that's actually the truth. You pay the deductible and then get it back when the claim is settled.This quote is hidden because you are ignoring this member. Show Quote

That’s a reason to ALWAYS get a rental car through insurance. That’s the number 1 way you can incentivize the insurance company to get shit done quick.

I think they had my C63 all patched up in a week once I rented another Mercedes on their dime from enterprise

Originally posted by Thales of Miletus

If you think I have been trying to present myself as intellectually superior, then you truly are a dimwit.

Originally posted by Toma

fact.This quote is hidden because you are ignoring this member. Show Quote

So in this scenario your company won't waive the deductible until the other side accepts liability. Sometimes that can take quite a while, up to a year. The solution is to pay the deductible up front and then when the other side finally accepts liability you get your deductible back. Or you can just wait of course. There are a bunch of reasons why this is the way it is but when the dust settles, it's just a fact of life.This quote is hidden because you are ignoring this member. Show Quote

As for $0 deductible yes there is a solution for that. Intact has a new product that will waive your deductible assuming at least $1000 damage in a hit & run and it will also waive the deductible in the event of a total loss (write off) excluding hail in Alberta.

"Masked Bandit is a gateway drug for frugal spending." - Unknown303

I wasn't joking. It seems obvious to me that you'd pay the deductible to get your life back to normal and then casually fight to get it back.This quote is hidden because you are ignoring this member. Show Quote

If my house burned down, I wouldn't freeze to death outside the smouldering foundation while attempting to negotiate why I shouldn't have to pay the deductible. This sounded similar.

Well it was a rear 1/4 cosmetic; car was drivable, just an eye sore.

A long time ago I took comprehensive off my car as it wasn't worth much and I've never claimed. 2 months later it caught fire (interior), got towed to the junkyard and I ate the cost of the car.

While it made sense financially, it was a pain in the ass and not something I'd like to repeat. As I got older, the cost difference between liability and comprehensive shrunk to the point it doesn't matter.

Yes that cost difference has shrunk materially over the years.

My dad religiously removed comprehensive after his spreadsheet told him and saved a ton. But over time, cost of repairs has gone up and with the comprehensive difference quite low it's not the same cost advantage anymore.

Again, insurance companies have done the Marth and are going to out Marth you. This is why it's been adjusted to what it is.

Comprehensive, I would never be without. Collision, I've gone bith ways.

This quote is hidden because you are ignoring this member. Show Quote

Point of clarification that a lot of people seem to struggle with, in auto insurance "comprehensive" does not mean full coverage, it's just one of the three main sections:

Liability - This pays for damage you do to someone or something else if you're at fault (fix the other person's car, pay for injury lawsuits, etc.).

Collision - Explained at length earlier but essentially fixes your car if you smash it up.

Comprehensive - All the other shit that can harm your vehicle besides an accident so that's hail, theft, vandalism, hail, impact with animal, fire, hail, windstorm and uhh...ya...HAIL! Friggin' Southern Alberta.

Last edited by Masked Bandit; 04-23-2021 at 02:21 PM.

"Masked Bandit is a gateway drug for frugal spending." - Unknown303

And oddly enough I recently learned that striking a deer or other animal will not get your car fixed unless you have COMPREHENSIVE.This quote is hidden because you are ignoring this member. Show Quote

That surprised me.

That’s pretty good, my pembridge broker told me it was approx $400 extra for collision and comprehensive for my cheap beater.This quote is hidden because you are ignoring this member. Show Quote

The only time I had liability only was when I was a young and racked up tickets and full coverage became too expensive. But now older and wiser with a clean record and with wife and kids that are starting to drive I go full coverage for piece of mind as long as the prices remain reasonable.

Sooooo many variables go into the pricing it's impossible for two people to compare anything. Shit, even within Calgary your specific postal code can swing the price 30% one way or the other.This quote is hidden because you are ignoring this member. Show Quote

- - - Updated - - -

Yep! Edited my post to include that one.This quote is hidden because you are ignoring this member. Show Quote

"Masked Bandit is a gateway drug for frugal spending." - Unknown303