just purchased some 38 & 37 puts on USO.

just purchased some 38 & 37 puts on USO.

TRUTH: it's the new hate speech.

In a time of universal deceit - telling the truth is a revolutionary act. - Orwell

What do you guys think of EnCana or other Gas plays (not talking about starting up companies, but established companies).

I don't know much about Natural Resource plays but am looking to diversify out my long term portfolio.

Natural gas isn't likely to jump much in the next five years or so. The abundance of Shale gas in both Canada and the US kind of puts a ceiling on the prices. In a way, it also provides a floor as well, somewhere around $4.50 per mmbtu, just due to the cost of developing these fields.

None of them are going to double anytime soon.

That being said, as long as you are looking for modest returns, gas plays like ECA, DVN etc are probably decent buys.

This quote is hidden because you are ignoring this member. Show Quote

Anyone else pick up BRK.B when they did a 50-for-1 split last month?

split took the price from $3500 to ~68, picked it up at 69 and now its at ~87... still a srong buy in my mind!

Also Suncor is at a huge discount right now imho, both of these are holdings that i'll keep for a while I think

going to throw up the monthly chart for euro, why? I think euro gives us a much clearer picture than of the USDX

look how obvious the abc correction is unfolding, unfortunately its nearly certain that euro is headed to 1.28-1.30 area before finding A bottom. the scary thing is, the massive H*S that is on the radar if the neckline around 1.2700 is broken to the down side, just the H&S target alone would push euro below par with the US dollar, and the fact that if this is a major wave III decline, it cannot be less than major wave I which gave us 1.6-1.23

truely some big movements ahead of us.

however the biggest signal for me is the 10/20 EMA on the monthly chart has now crossed over, if you think this is big, think bigger.

_________

2019 IS350 AWD

20xx NX350 AWD

With the expectation of the market taking another dive, do you guys keep mostly cash? I don't have much in terms of stocks left, just some gold and NG bull. However I do have a substantial amount and am wondering if I should pull out even with the penalty in mind. Keep cash, and put into other things like forex, or buy into stocks at lower points.

You know when your financial advisor tells you when prime is 3 ish and your mutual fund gets a predicted return of 6-12% everything will be rosy if you put in a decent amount monthly. Well, the problem s when over several months the market takes a dive and you lose 20% or more in your portfolio. I have been putting $ into this TD growth fund but now am wondering with today economy is it still reasonable to expect positive returns say 9 out of 12 months.

What I'm doing is seeking income producing investments. Something that will spin out cash over the next 12 months regardless of share valuation. stocks like SPB, SXP.UN, REI.UN, RSI.UN etc.

Funny thing is that they seem to be holding thier value pretty well in addition to paying me for every month I own them.

This quote is hidden because you are ignoring this member. Show Quote

I thought that Trusts all had to convert to corporations ?? This year???Originally posted by ExtraSlow

What I'm doing is seeking income producing investments. Something that will spin out cash over the next 12 months regardless of share valuation. stocks like SPB, SXP.UN, REI.UN, RSI.UN etc.

Funny thing is that they seem to be holding thier value pretty well in addition to paying me for every month I own them.

Edit: I think its 2011...

Last edited by broken_legs; 03-30-2010 at 06:15 AM.

TRUTH: it's the new hate speech.

In a time of universal deceit - telling the truth is a revolutionary act. - Orwell

Yeah, Jan 1, 2011 is the date.

But, the way I see it, much of the downside related to that conversion is already priced into these equities. It's not like you'll take they'll take 100% of that hit the instant they convert. The downside is well known and documented, so it's not like the market hasn't taken that into account in curent pricing.

Plus, a lot of them will convert to regular corporations that pay high dividends, much like Superior Plus (SPB) and Premium brands (PBH) have done. Those are two companies that did incredibly shrewd deals to avoid paying tax for several years. Check them out.

This quote is hidden because you are ignoring this member. Show Quote

It seems everyone here is mostly interested in oil and gas stocks and the like... but what does everyone think of ford as a long term investment??

Also, do companies stocks tend to go up after making large sales, or do they have to exceed their own forecast? The reason im wondering is I have been thinking about investing in Blizzard Activision, due to impending release of starcraft 2 and diablo 3 in the next year and a bit, which will undoubtedly be insane sellers.

Opinions or advice is welcome!!

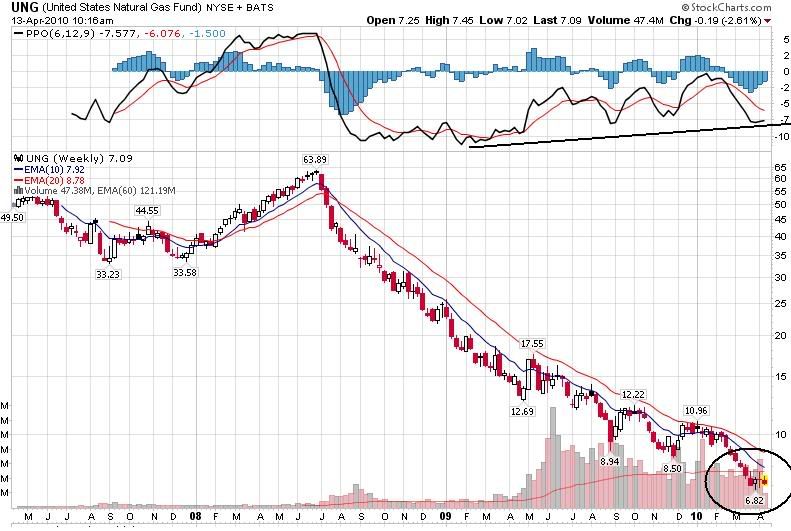

Keep in mind thats a Logarithmic Scale.

TRUTH: it's the new hate speech.

In a time of universal deceit - telling the truth is a revolutionary act. - Orwell

O&G dominates investingin Calgary, just the nature of the beast. I've worked hard to diversify out of that sector, but it's tough when that's what most of us know best.Originally posted by riander5

It seems everyone here is mostly interested in oil and gas stocks and the like... but what does everyone think of ford as a long term investment??

Also, do companies stocks tend to go up after making large sales, or do they have to exceed their own forecast? The reason im wondering is I have been thinking about investing in Blizzard Activision, due to impending release of starcraft 2 and diablo 3 in the next year and a bit, which will undoubtedly be insane sellers.

Opinions or advice is welcome!!

Ford is in a relatively strong position, but the auto sector isn't exactly a hotbed of profitability. Plus, it's such a huge company that it is pretty hard to make a big impact on it's bottomline with one or two successful products. They need a handful to really affect the share price over the longer term. Still, the price is pretty low . . . . .

This quote is hidden because you are ignoring this member. Show Quote

here is another food for thought, another opinion as to why NG may have bottomed

look at UNG in the following chart, notice the two candle formation? a hammer follow by a doji. I recall learning some where in the past that this is typically the most powerful brakes you put in a chart.

while plenty of other indicators will take some time to turn the chart bullish, the current NG movement is definately worth the risk/reward

_________

2019 IS350 AWD

20xx NX350 AWD

..

_________

2019 IS350 AWD

20xx NX350 AWD

Looks like China's demand for NG is increasing too. NG may have bottomed.

What's a good way to play NG outside of ETFs? Futures? Options? I've never bought either before and am curious how one goes about doing so.

How about the tried and true method of buying stock in natural gas companies?

ECA is the big name.

This quote is hidden because you are ignoring this member. Show Quote

,

Originally posted by ExtraSlow

How about the tried and true method of buying stock in natural gas companies?

ECA is the big name.

I think you should try 50/50 Gas Stocks and ETFs if you can.

NG looks like a sure bet here... but... What happens if the market tanks again? NG can go higher, general market can crash bringing down all stocks with it limiting your returns.

Not to mention if you are going to get into a NG stock, make sure you know what exposure they have to their hedges. ie how much production is hedged at 5.00 when NG is trading at 15 again after the next hurricane.

TRUTH: it's the new hate speech.

In a time of universal deceit - telling the truth is a revolutionary act. - Orwell

NG isn't as sure of a bet as it looks.

The supply side of the equation is fundamentally different now than during our last big spike due to shale gas. There are huge supplies that can be brought onstream within relatively short timeframes that will act as a ceiling to the NG price.

I'm bullish on gas, but my prediction is that it'll be a pretty slow climb for the next two years to somewhere in the $6 area. Good news is that most of the majors are profitable at that price. Many juniors are not, and I think you'll see a wave of consolidations in the Canadian junior sector

This quote is hidden because you are ignoring this member. Show Quote

here is something that may be the case if oil does not explode higher, considering how dollar has strengthen in the last few months, oil did not really pull back the way it should relative to the USD strength index, then again the strong USD can be mostly related to a falling euro.

if the market is to peak out and begin pulling back towards the summer month, I cant help but wonder how oil will do if the dollar is to continue higher. so my view is that best case scenario is to see oil obviously breakout to higher highs, but worse case could see us continue to move side ways in some sort of triple zigzag flat, extended 3 waves correction. then once the general market does its semi-larger correction, everything will take off towards year end.

_________

2019 IS350 AWD

20xx NX350 AWD