Canada.

The land of the strong and free. The land of fiscal prudence. Or so we have been told.

Jim Flaherty has been so surprised that Canadians believe him when he says that we are fiscally prudent, that he has decided to assemble a task force to look into the matter. Headed by Don Stewart from SunLife, the team will dive deep into this quandary.

In a conversation with Australian economist Steve Keen, he alluded that he might be involved in this task force as well. He's got a good head on his shoulders. These are the questions he'll be pondering:

* With the Bank of Canada's interest rate set at 0.25%, how is it that 1/3 of Canadians are struggling financially? What happens when interest rates double, and the cost of debt does as well?

* Studies suggest that Canadians are wildly overly optimistic about their financial picture.

* Why Canadians feel that they'll retire comfortably but can't verbalize or explain how that will happen... and they generally start to drool and stutter.

Well I can answer why they feel this way. The government, banks, media and associations in this country keep telling Canadians that they're fine. In fact they brag about how financially responsible Canadians are to people around the world.

But here is the reality. We've been living a lie. We've been listening to interested groups of people who of course benefit from our inaction. The truth is we have been anything but financially prudent.

This is what Don and Steve will find:

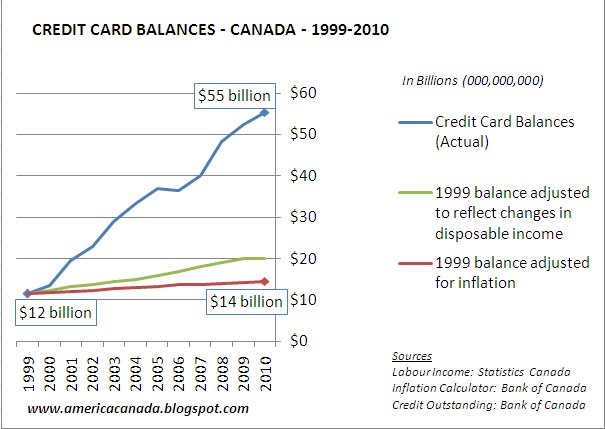

(Note that there has been some confusion on this blog about the following graphs. The graphs show the actual changes to outstanding credit (blue line). They also show two other lines. Both make changes to the 1999 balance only (or 2002 in the case of household credit). The inflation line shows what the credit would look like had the 1999 balance grown at the rate of inflation. The purpose of the disposable income line is to show how much debt would exist if the debt-to-disposable income ratio was maintained at the 1999 level - which even then was a historically high figure)

CREDIT CARD BALANCES - 1999-2010

Credit card balances are up 458% in 11 years.

Please keep in mind that when credit inflation is this large, you have to question its impact on disposable incomes - that is, are those incomes sustainable when the credit ceases to expand or more likely, contracts. They are not and as evidence of this, real wealth gains would drive the debt to disposable income rate down. Real higher incomes provide savings and the ability to pay down debt. The fact that this is not the case, suggests that the incomes and the economy are heavily inflated by debt.

Credit Card Balances - Canada - 1999-2010

Note that in the graphs I adjusted the total credit outstanding in 1999 to reflect both inflation and disposable incomes over the course of the decade. This gives you an idea of what the 'real' amount outstanding in 1999 would look like today.

(ie. $11.5 billion in 1999 has the same worth as $14.5 billion today)

RESIDENTIAL MORTGAGES

In 1999, outstanding residential mortgage debt was $399 billion. Eleven years later, it has expanded by 242% to $965 billion.

Residential Mortgage Debt - Canada - 1999-2010

That looks scary. The $965 billion is the figure quoted most often by the media, and even myself. But it's missing an important trend that has occurred over the past ten years. Canadians have been tapping into the their home equity to finance purchases and mortgages at extraordinarily low variable interest rate through Home Equity Lines of Credit.

PERSONAL LINES OF CREDIT

Home equity lines of credit have become the drug of choice for Canadian consumers. They use them to finance everything from cars to furniture to home renovations, and of course, mortgages.

Between 1999-2010, lines of credit grew 820% to $205 billion.

Personal Lines of Credit - Canada - 1999-2010

HOUSEHOLD CREDIT

As a result of credit cards, lines of credit and residential mortgages, household credit has expanded from $669 billion in 2002 to $1.41 trillion in 2009. Despite a small reprieve for a couple months in early 2009, it has been growing by roughly ten billion per month. By the end of 2010, Canada's household debt-to-disposable income will be roughly 155% (currently 146%).

Household Debt - Canada - 2002-2009

In my next post I'll prove to you that we weren't even in good shape in 1999 or 2002. This trend started in the 1980s. I'll also discuss why economies that are inflated by credit tend to be more stable with shorter and less intense recessions - hence why Canada's economic picture has been so rosy since the mid eighties. In fact the only period where household credit decelerated was during 1990-1995 - look at how that worked out for us. And in this coming credit contraction, you should expect volatility, with recessions occurring on a regular basis every few years. They will be sudden and damaging.

Jonathan Tonge

www.americacanada.blogspot.com

Quote

Quote