Hoping someone else can shed some light on this, in case I am missing anything.

Mortgage balance of 500K (today), started Sept 2017

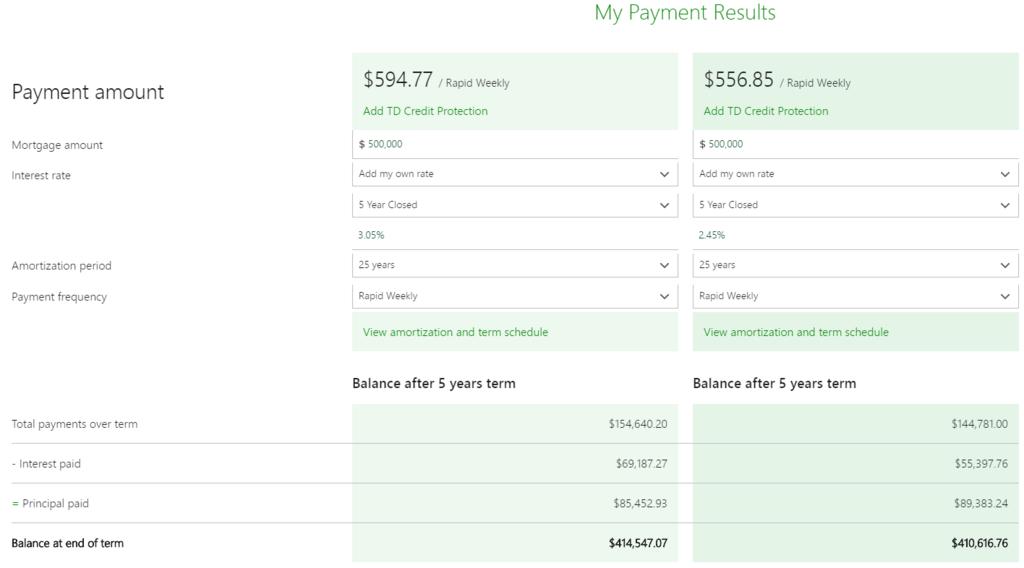

Current rate: 5 year variable - weekly accelerated - prime minus 0.4% - 3.05%

If refinanced: 5 year variable - weekly accelerated - prime minus 1% - 2.45%

I did some comparisons using TD's mortgage calculator (3.05% vs 2.45%), is it worth refinancing the rate to get the interest 0.6% lower?

Is $4k in fees realistic?

IMO seems like it would be a good move, saving about $5-6K after a 5 year term (assuming penalty is around $4k). Am I missing any other variables? Other things to consider?

Thanks

Quote

Quote