It probably answers itself, but if you make a claim for a special assessment, does your premium go up as a result?This quote is hidden because you are ignoring this member. Show Quote

2020 fees lower than 2019

No change

0-1%

1-2%

2-3%

3-4%

4-5%

5-6%

6% or higher

It probably answers itself, but if you make a claim for a special assessment, does your premium go up as a result?This quote is hidden because you are ignoring this member. Show Quote

sig deleted by moderator, click here for info

$0.22/sqft. Excluding basement.

1250 sqft Townhouse, single attached garage, single car driveway, patio. No utilities. 76 units.

I didnt know this existed but im calling my broker tomorrow. Fuck im all paranoid now lol Seeing what some of you guys pay and how much your fees have gone up in the short amount of time has me trippin.This quote is hidden because you are ignoring this member. Show Quote

This quote is hidden because you are ignoring this member. Show QuoteThis quote is hidden because you are ignoring this member. Show Quote

$0.14/square foot, does not include utilities.

$0.44/ sq.ft

Wood frame condo from the 80s, includes heated underground parking, heat and water. No amenities, no elevator. Internet and electricity extra.

Ultracrepidarian

No special assessment. Building was turned into condo units from rental appartments in early 2000's in lower Mount RoyalThis quote is hidden because you are ignoring this member. Show Quote

- - - Updated - - -

Everyone's costs are an eye opener for me. I thought our rates where on the low end, but seem to be the opposite.

- - - Updated - - -

Are you on the board by chance? Yours seems similar to mine and would be nice to compare costs/reserves. How big is the building?This quote is hidden because you are ignoring this member. Show Quote

I think it's ~30 units +/- a couple. I just got on the board and we recently had our AGM. Insurance was the one thing that keeps hammering us, and strangely garbage/recycling costs from the city -- we're seriously looking into going through a private entity here. Also, we made an insurance claim a couple years ago which repaired the siding and roof which were big ticket items but even before then it was creeping up.

Ultracrepidarian

WTF is that? Lol I'm calling Touchstone XDThis quote is hidden because you are ignoring this member. Show Quote

I only have content insurance. At least, I think that's what it's called.

Everyone that has condo insurance has coverage for special assessments IF it's the right kind of assessment, normally things like deductible back-charge. If the SA is for maintenance related costs (building needs a new roof for example) then that's not covered and you can't buy coverage at any price for that. Same with all these places that have to redo the building envelope...that's not covered / can't be covered.This quote is hidden because you are ignoring this member. Show Quote

"Masked Bandit is a gateway drug for frugal spending." - Unknown303

Can the condo board buy insurance for those items?This quote is hidden because you are ignoring this member. Show Quote

This quote is hidden because you are ignoring this member. Show Quote

From what I vaguely remember looking into it. The special assessment insurance only covers stuff like accidents or lawsuits right? Like if someone slips on ice at the condo and then sues the condo corp (and wins) for an amount that is above the condo's insurance policy, the remainder would get passed onto the tenants as a special assessment? And that would be covered by your units insurance policyThis quote is hidden because you are ignoring this member. Show Quote

This quote is hidden because you are ignoring this member. Show Quote

Largely, no. Just the same as you can't buy it for your own single family detached home. If I need a new roof just because my current one is too old / worn out insurance isn't going to pay for that, it's just homeowner maintenance.

The deductible back-charge is a big one for condo unit owners and there's always coverage for this to a point included on a comprehensive condo owner's policy. However in recent years we've been seeing condo corporation policies increase the deductibles from $5K / $10K up to shit like $50K or even $250K, and that's where there can be some gaps in coverage.This quote is hidden because you are ignoring this member. Show Quote

"Masked Bandit is a gateway drug for frugal spending." - Unknown303

Does it matter if they are redoing the building envelope before or after damage?This quote is hidden because you are ignoring this member. Show Quote

ie.

Condo spends money to redo building envelope proactively and sends out a SA to all owners to cover costs - NOT covered

Condo experiences a flood event and major damage occurs due to improper building envelope. Repairs include redoing building envelope. SA to cover costs. - Covered?

Reason I ask is that the SA coverage I have says it will reimburse my portion of any damages caused to common area caused by a risk (peril).

---

If damage occurs to a common area due to an insured peril then yes, the SA you receive will be covered. If it's just maintenance though you're on your own. Most of the building envelope issues I've heard about are discovered due to mold or other symptoms and it's not due to anything specific like a flood...just shit work during construction.This quote is hidden because you are ignoring this member. Show Quote

"Masked Bandit is a gateway drug for frugal spending." - Unknown303

Got a letter from the management company today and was prepared for the worst.

Was paying $524.19 for the last couple of years. Next year I'm paying $531.40. Whew!

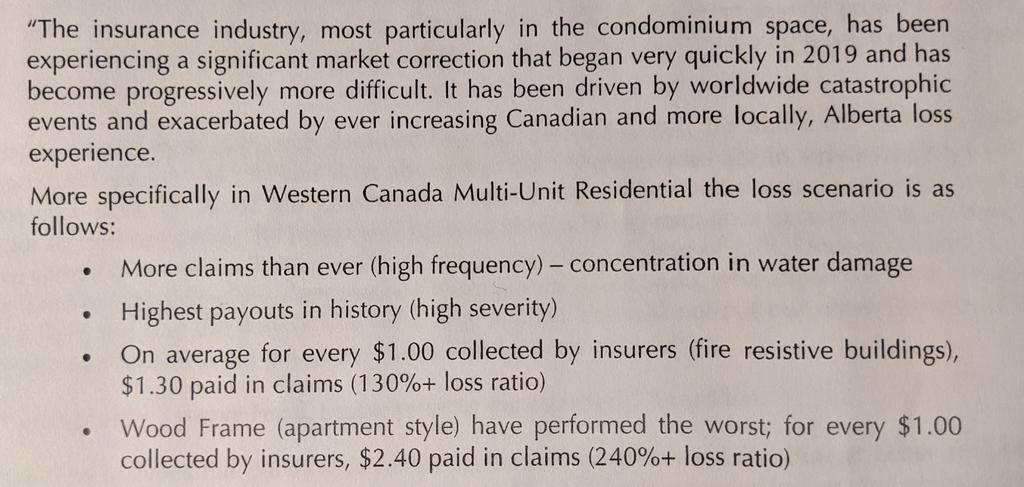

According to my board, it does make a difference. I'm in a concrete building. Everything is going up, just more so with wood frame (less fire resistant) buildings. They even quoted our insurance providers statement in the 2020 budget documents explaining the reasons for the insurance rate increase:This quote is hidden because you are ignoring this member. Show Quote

While there is the less underwriters in the Condo market, the way Condo insurance works is stupid. For example, say you have a unit that has a replacement value of $100,000,000. No single underwriter will insure it 100%, so the various underwriters come in and take chunks of it. Whatever the last chunk is priced at, the rest of the underwriters get the same amount. So if you had a situation such as:

First 50,000,000 @ $0.10 per 10k insured

Next 25,000,000 @ $0.15 per 10k insured

Next 20,000,000 @ $0.20 per 10k insured

Last 5,000,000 @ $0.35 per 10k insured

It doesn't mean that you will end up paying the premiums at that threshold, the first three will get automatically bumped up to $0.35 per 10k insured, even though they were willing to insure at a lower rate. So everyone will be making $0.35 per 10k insured. This to me is the offensive part, why do the other three get a bump up when they were willing to accept the risk at a lower premium. Technically, with so few underwriters, there is most likely one that is causing these massive increases.

I think this really depends on how many insurers are involved. If 4 major players are already insuring this building then they know it is unlikely to have competition. But keep there are RI commissions and RI fees in these types of contracts. And on a technical standpoint, your 2nd, 3rd, and 4th layer cannot be more expensive than the previous layers.This quote is hidden because you are ignoring this member. Show Quote

Keep it short, insurance is a profit driven industry.

Originally posted by beyond_ban

Yo Kanye, ima let you finish, but 50 Cent had the best concert cancellation of all time.

Condo in bankview caught fire yesterday, probably going to continue the trend of making condo insurance worse

You would think so, but because each company is only willing to accept risk at whatever price point they come in at, typically it is that last block of insurance that is the most expensive and thus results in overall higher insurance since everyone gets it at the value that the last insurer comes in at to fully insure the building.This quote is hidden because you are ignoring this member. Show Quote

I am not sure what you are talking about. If it is a RI agreement, then rates needs to be aligned. Thats why it does not matter in positioning. However, the last "block", or I call excess, is usually the more expensive one because it is covering a small sum assured. Meaning lower gross premium. Therefore, the insurer covering the smallest piece of the pie, will charge higher "rates" to get more premium.This quote is hidden because you are ignoring this member. Show Quote

Ive been a technical uw for a long time..

Originally posted by beyond_ban

Yo Kanye, ima let you finish, but 50 Cent had the best concert cancellation of all time.