Meanwhile MEG's cost for one barrel of oil was 89 cents.

Meanwhile MEG's cost for one barrel of oil was 89 cents.

I approve of this backyard math.This quote is hidden because you are ignoring this member. Show Quote

For @89coupe and others, Politics means that companies now need to throw an extra 2-3 billion on the front end, and decades of delay, and about a 50% risk of not going ahead even if approvals are obtained through whatever regulatory process. Political economics are the issue, not MARKET economics.

This quote is hidden because you are ignoring this member. Show Quote

You are as brain washed as Greta.This quote is hidden because you are ignoring this member. Show Quote

I don't think you are a credible resource for information on that, or on the risks and economics of major projects. If you have knowledge in this area, you hide it well.This quote is hidden because you are ignoring this member. Show Quote

This quote is hidden because you are ignoring this member. Show Quote

I had a long drawn out sarcastic remark written, changed my mind, just going to lol

Originally posted by Thales of Miletus

If you think I have been trying to present myself as intellectually superior, then you truly are a dimwit.

Originally posted by Toma

fact.This quote is hidden because you are ignoring this member. Show Quote

Don't fuck with the #philfans

How dare you! You have stolen his dreams and his childhood with your empty words.This quote is hidden because you are ignoring this member. Show Quote

Nothing of substance to reply with, so here is some ad hominen for you!This quote is hidden because you are ignoring this member. Show Quote

Why even waste time with your back of napkin math when experts have already done it? Here is an article from the war room that states break even on a new mine is $65:This quote is hidden because you are ignoring this member. Show Quote

https://www.canadianenergycentre.ca/...teck-frontier/

So now you have a project that nets you 10% return based on a forecasted price of $71USD. Itís just not enough of a margin with all the risk including political. Even in a hypothetical scenario where ther is 0 political/indigenous risk, itís still risky because who the fuck knows how oil demand or prices will be between now and 2066.

Again Iím not saying politics had nothing to do with it, but my view is poor economics is the bigger factor

Thanks brother. You feel that’s pretty realistic? It’s a shame the media puts these expectations out there of 100WTI. What might need to be looked at again is ROI for these projects. We’re still stuck in a fairy tale unfortunately.This quote is hidden because you are ignoring this member. Show Quote

Media should read project needs 100WTI for record profits and ROI of 7 years lol.

"The most merciful thing in the world, I think, is the inability of the human mind to correlate all its contents... some day the piecing together of dissociated knowledge will open up such terrifying vistas of reality, and of our frightful position therein, that we shall either go mad from the revelation or flee from the light into the peace and safety of a new Dark Age."

-H.P. Lovecraft

Nice link, thank you for that.This quote is hidden because you are ignoring this member. Show Quote

I caught this though - and it’s important:

CNRL has dropped 12% in Op cost since 2018. My $60WTI is in the money.A 2019 study by IHS Markit said that the breakeven oil price for a standalone oil sands mine to achieve a 10 per cent rate of return fell from nearly US$100 per barrel WTI in 2014 to approximately US$65 per barrel in 2018, thanks to cost deflation and re-engineering.

Now - like we said - if we had another pipeline right now, reduce that amount by another 10-15%.

So we’re deeply into the 50’s. With a return.

Chicken or the egg, the political concern is the chicken. Can’t lay a pipeline egg to allow any projects to proceed.

Good discussions.

Edit: forgot to add in 20 years when oil is naturally inflated due to the cost of bread in Nickles, $70 WTI will be the depressed number. It’ll be the new $50.

Profitttts. All the forecasters know this, what articles in the media don’t tell you are the real life, true statements regarding projects, break even points and so forth

Last edited by Darkane; 02-29-2020 at 04:45 PM.

"The most merciful thing in the world, I think, is the inability of the human mind to correlate all its contents... some day the piecing together of dissociated knowledge will open up such terrifying vistas of reality, and of our frightful position therein, that we shall either go mad from the revelation or flee from the light into the peace and safety of a new Dark Age."

-H.P. Lovecraft

Not a new build but another extension:

https://www.iaac-aeic.gc.ca/050/evaluations/proj/80521

I'm just skimming so maybe I glanced over it, but are people missing that our oil is not sold at WTI and that the discount down is a fluctuating number?

That's kind of extremely relevant, non?

Hence - political - pipelines.This quote is hidden because you are ignoring this member. Show Quote

That’s why we have such a desperate need for pipelines. WCS rises and stabilizes with pipelines to the coast, but not with pipelines to the south. Big difference.

"The most merciful thing in the world, I think, is the inability of the human mind to correlate all its contents... some day the piecing together of dissociated knowledge will open up such terrifying vistas of reality, and of our frightful position therein, that we shall either go mad from the revelation or flee from the light into the peace and safety of a new Dark Age."

-H.P. Lovecraft

Right. It's impacted by a variety of factors. So why is all the Marth on this page:This quote is hidden because you are ignoring this member. Show Quote

"Bro, if WTI is $65 we set!"

"Nah, Bro. Need WTI $82 fo real!"

"Bro - my daddy's Co. can make bank at $41 WTI."

etc

The product is sold at WCS which is not linearly tied to WTI. I'm not going to say "WTI price is as relevant as the price of a bushel of wheat" but why not base math off of the relevant index instead of Marth?

Not all oil sands product is sold at WCS so WTI is just a consistent reference point and oil sands product prices follow WTI pretty closely so it's just the differential. And the differential is a lot smaller for the big producers (with upgraders).This quote is hidden because you are ignoring this member. Show Quote

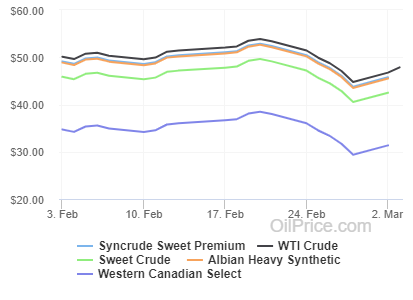

Edit - couldn’t add a pic from my work computer! Have to do it from my phone...here are the recent prices for WTI, WCS and other oil sands products for reference:

Last edited by never; 03-03-2020 at 10:17 AM.

Historic charts, demand etc.This quote is hidden because you are ignoring this member. Show Quote

You can forecast pretty easily. Keep in mind WCS must have enough differential to be profitable versus WTI. What does that mean?

To sell synthetic at a profit margin. Or in a perfect world upgrade and refine at the same facility.

Then you can buy WCS at say $5 discount to WTI and still make money on the refined product.

"The most merciful thing in the world, I think, is the inability of the human mind to correlate all its contents... some day the piecing together of dissociated knowledge will open up such terrifying vistas of reality, and of our frightful position therein, that we shall either go mad from the revelation or flee from the light into the peace and safety of a new Dark Age."

-H.P. Lovecraft

Man I hope nobody's read MEG Energy's Q3 2019 report.

I have a hard time believing the national observer on the best of days, but when they say this "...The company (Teck) took a $910-million after-tax loss on the project (Fort Hills) during the fourth quarter of 2019."This quote is hidden because you are ignoring this member. Show Quote

In reality it was a $910 million impairment. Fort Hills netback was $11.85/bbl and earnings before depreciation and amortization was $144 million

Last edited by dirtsniffer; 03-03-2020 at 05:31 PM.