Seems like an odd thing to get hung up on lolThis quote is hidden because you are ignoring this member. Show Quote

Seems like an odd thing to get hung up on lolThis quote is hidden because you are ignoring this member. Show Quote

Originally posted by Thales of Miletus

If you think I have been trying to present myself as intellectually superior, then you truly are a dimwit.

Originally posted by Toma

fact.This quote is hidden because you are ignoring this member. Show Quote

"Inflated view" of something one way or the other. And I've worked in oil and gas for 20 years now and understand what's required.

This quote is hidden because you are ignoring this member. Show Quote

Not hung up on it. I just think it's an interesting choice of words.This quote is hidden because you are ignoring this member. Show Quote

Yeah I saw that one a few days ago. Accurate, and funny.

This quote is hidden because you are ignoring this member. Show Quote

No CommentThis quote is hidden because you are ignoring this member. Show Quote

Originally posted by Thales of Miletus

If you think I have been trying to present myself as intellectually superior, then you truly are a dimwit.

Originally posted by Toma

fact.This quote is hidden because you are ignoring this member. Show Quote

USA shale oil decline discussion in elegant terms:

https://www.oilystuffblog.com/chart-stuff

This quote is hidden because you are ignoring this member. Show Quote

Wouldn't a bunch of those wells be shut in for 2020 with the massive drop in prices though? Presumably they'll rack production back up soon?

No idea, genuinely curious

That graphic is a snip of a larger one, you can play with it yourself at https://shaleprofile.com/blog/us/us-...november-2020/.

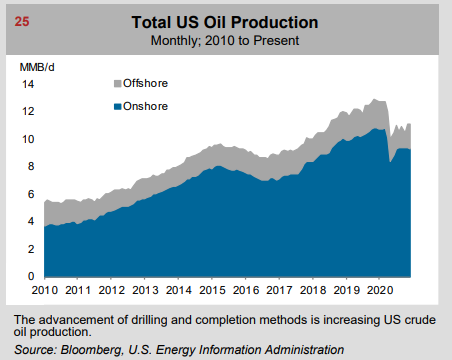

My read on the situation is that while there were shut-ins for 1-2-3 months in 2020, there is no longer any significant onshore US production shut in voluntarily.

The compounding effects of decline on top of decline (AKA the shale treadmill) is a real physical fact, but total production seems to be pretty stubborn. I don't have a complete explanation. I also don't believe there is enough "DUC" inventory to make any difference to this situation.

I think I've been saying for something like 18 months that "we'll see these declines kick in any day now". So far, I'm the one who looks uninformed.

This quote is hidden because you are ignoring this member. Show Quote

Fascinating stuff, didn't realize the world of economics surrounding shale was like this.And when it came to cheap credit, this came in the form of reserved-based lending facilities or RBLs. These credit lines were, in our view, the key reason why smaller US shale companies outspent massively. The reasoning was simple:

Every six months, banks in the RBL would assess the progress the company made on its drilling and exploration program (e.g. capex). And the greater the progress (e.g. more money spent), the more reserves could be derisked. The value of the RBLs was assessed on the proven portion of the reserve book. Banks usually took 65 cents on the dollar to whatever the proved reserve value was. And since banks didn't assess producers on its cash flow or free cash flow generation, but rather the reserves. Companies found out that the more they borrowed and spent on proving the reserves, the more money they could borrow.

This self-reinforcing positive mechanism allowed companies to keep borrowing and drilling without any consequences. Until of course, the $100/bbl oil days were over and companies realized that RBLs were a double-edged sword. But that's not even the worst part. The oil crash that followed was rather short lived and since 2014 to 2017 saw massive improvements in productivity gains, companies realized they could still do the same type of outspending and prove reserves but just at a lower price.

Then came COVID-19 which made RBLs worthless. What we mean by that is in a normal market environment where WTI could say bottom at $40/bbl, an RBL still had value because the banks could underwrite the reserves at that $40/bbl price. But in the COVID-19 pandemic, WTI went negative. And it didn't matter if the forward oil price outlook was $40 in 2021, the net present value calculation of the reserved based lending model made all current and proven reserves essentially worthless.

Banks then quickly realized that the entire RBL model was built on false pretenses of reserves. And companies are realizing today that RBLs are not really liquidity given the banks' ability to reassess every six months.

To put it simply, RBLs will be practically nonexistent by the end of 2021. Banks that have credit lines out with producers today are in the form of covenant based facilities, which are not subjected to the same onerous semi-annual determinations. These will likely replace RBLs, but since covenant based facilities have stricter limitations and are actually based on cash flow metrics, producers will be forced to spend within cash flow rather than the loophole we saw in the previous cycle.

This fundamental change in how credit is going to be provided to US shale will be a night and day difference in how US shale grows in the future. And given credit availability is extremely tight and only available to the fortunate large producers, the growth engine that propelled the US to become the largest oil producer is no longer there.

Weekly EIA production in USA is 11.0 million barrels again. Same data as the chart I usually post, just in graphical format.

Country-wide decline doesn't exist, and I've proven I don't understand that.

This quote is hidden because you are ignoring this member. Show Quote

If Biden puts in a USA wide carbon tax, its going to shake up everything.

My buddy mike talks about DUCs.

https://www.oilystuffblog.com/news-stuff

After what the shale oil industry has been through the past two years we must assume that every DUC worth frac'ing, was frac'ed, and what's left, represents a nearly $1B liability to the sector.

This quote is hidden because you are ignoring this member. Show Quote

ConocoPhillips to sell Cenovus Energy stake.

https://financialpost.com/commoditie...e-and-cut-debt

Didn't these clowns just finish buying these clowns about 20 min ago??! WtF?

*Not sure what thread makes sense or if worth new MeGaThReAd

Last edited by ThePenIsMightier; 05-04-2021 at 07:22 AM.

Cenovus bought Conoco's Canadian operations, partly by giving Conoco USA a shitpile of shares. Conoco USA was never going to hold those long term.

This quote is hidden because you are ignoring this member. Show Quote

I kinda hate the way this guy writes, but the message is reasonably compelling. USA tight oil has not been profitable.

https://runelikvern.com/2021/05/10/t...s-of-end-2020/

This quote is hidden because you are ignoring this member. Show Quote

"Busiest Q2 that I can remember" is something I am hearing a lot lately. Which is the exact opposite of what I'm experiencing sitting on my ass waiting for road bans to lift, but I'm glad to hear the optimism in the industry and see wheels turning even if mine aren't. Hopefully this this continues for the rest of the year.

This quote is hidden because you are ignoring this member. Show QuoteOriginally Posted by Sugarphreak

This quote is hidden because you are ignoring this member. Show QuoteThis quote is hidden because you are ignoring this member. Show Quote

There are pockets of activity, and a lot fewer companies to service the work, so I have no doubt a few people are quite busy.

This quote is hidden because you are ignoring this member. Show Quote

Q2 is shaping up to be busier than Q1 in Canada for us.. First time that has happened. Not our biggest Q2 though. Hopefully a sign of things to come.