The first rule of 7.2...is you dont talk about 7.2This quote is hidden because you are ignoring this member. Show Quote

The first rule of 7.2...is you dont talk about 7.2This quote is hidden because you are ignoring this member. Show Quote

Dude. Unless it's a fee-based advisor, you are going to be talking to a salesperson.This quote is hidden because you are ignoring this member. Show Quote

Follow the steps I outlined unless you really want another person, who wants to sell you investments, to tell you a version of the same.

So that’s why AMG is going to 73, this all makes complete sense now.This quote is hidden because you are ignoring this member. Show Quote

Originally posted by Thales of Miletus

If you think I have been trying to present myself as intellectually superior, then you truly are a dimwit.

Originally posted by Toma

fact.This quote is hidden because you are ignoring this member. Show Quote

Sometimes the best way to learn is slowly. If OP ends up getting years of janky returns, it might inspire him to think about why and seek out learning material as mentioned.This quote is hidden because you are ignoring this member. Show Quote

Providing an investing "panacea" like VGRO with context just doesn't do the job sometimes, especially if they don't know what they want and also because money is a deeply personal thing.

TL;DR, OP doesn't know Beyonders from Joe Blow off the street and wants to experience the journey himself. I respect that.

PS: Going to break Buster's rule and just let OP know that 7.2 is a stupid inside joke about needing millions to retire, so he can separate the jokes from the real talk.

There has been sound advice in here and you can still go and see an advisor and ask them about some of the topics discussed here. I would agree that you should avoid buying any mutual funds that they may try and sell you but make sure you open the following accounts while you’re there.

- high interest savings account

-direct investing TFSA account

- direct investing RRSP account

I’d recommend that until you’re confident enough to take the plunge and buy VGRO and load up either your TFSA or RRSP, separate your savings from your chequing account so you’re gaining a bit more interest and you’ll be less tempted to spend it.

I like neat cars.

Don't worry about it if your kids drink pop.This quote is hidden because you are ignoring this member. Show Quote

Kind of off topic to the original purpose of the thread but ties into what is being discussed above.

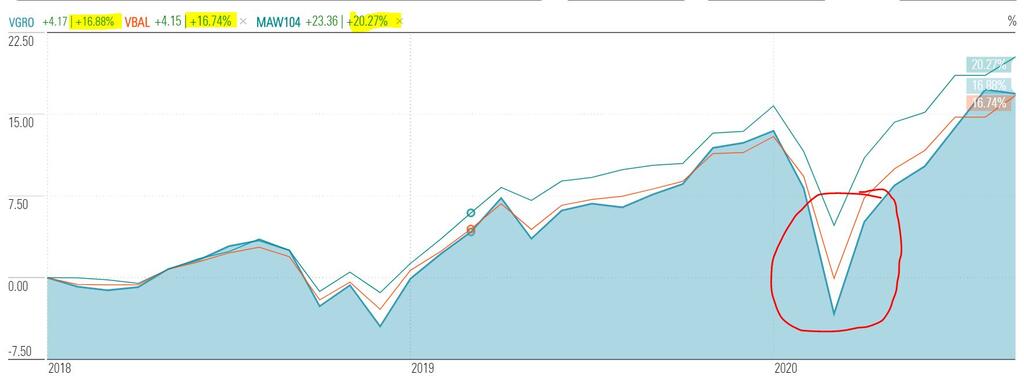

ETF's are great for their low cost, but it is interesting that VGRO is touted as the "higher risk" where VBAL is considered "lower risk", however if you look at their performance Since Inception, it is almost identical (all be it less than 5 years) however, the volatility experience in VGRO is elevated, which could lead to emotional decisions. See chart below.

I know it is crazy to think investors still make emotional decisions, but the pain threshold an investor is willing to tolerate before they throw in the towel is very real.

Also, I know that MUTUAL FUNDS ARE BAD, is the consensus opinion on beyond, however, there are still some great, low cost, funds out there.

Take "Mawer Balanced" as an example. I charted it out against VGRO and VBAL, since those were launched, and you can see a bit better performance, but also less downside performance, which would likely keep an investor invested.

Plus the MER is 0.91%. Downside is you need $5k minimum to purchase.

These opinions are entirely my own and do not represent any other person or organization.

I like Mawer. I hate that OP ignores my helpful suggestions.

I think he should buy options on leveraged ETFs on margin against a HELOC. What could go wrong?

With the advent of ETFs (generally lower fees and broader portfolios) I'd stay away from mutual funds entirely. Furthermore I don't think there are any brick-and-mortar financial institutions that offer a high interest savings account with an interest rate that is even remotely competitive - I believe that their non-promotional rates are all 0.25% or less. The larger banks I bank with are TD and HSBC, and I only use them for their investment accounts (TFSA, RSP, LIRA, unregistered CAD/USD accounts).This quote is hidden because you are ignoring this member. Show Quote

Check out https://www.highinterestsavings.ca/chart/ for the best high interest savings accounts. I have ones with Bridgewater, Motive, EQ Bank, AcceleRate, Achieva and Hubert. Only the ones with Motive and EQ Bank have non-negligible amounts in them at the moment. EQ is probably the easiest bank to work with. Motive is OK. Most of the others are still kind of stuck in the 20th century. You still can't do things online with Bridgewater. I should get around to opening an account with Canadian Tire bank (to chase that 0.05%, lol) but they'll probably lower their rates just in time for my account opening. I also have (or had) accounts with Tangerine, Simplii, and Manulife, who can offer competitive promotional rates, but lackluster (think < 0.25%) regular/everyday interest rates.

Follow the money steps here: https://www.reddit.com/r/PersonalFin...ki/money-steps

Personal finance writers who give out good advice (imo) are Gail Vaz-Oxlade, David Chilton, and Andrew Hallam. Ones I'd can't recommend include Dave Ramsey and Robert Kiyosaki.

From personal experience, this is accurate.This quote is hidden because you are ignoring this member. Show Quote

Ultracrepidarian

RE: VGRO vs. VBAL - while their performance over the last couple years has been similar, expected returns in the future shouldn't be. Volatility and expected return are primarily driven by asset mix - ie the ratio between stocks and bonds. VGRO has higher stock exposure (80%) than VBAL (60%), and therefore has a higher expected return over the LONG TERM. I'd take that bet 100 times out of a 100. If we are talking about RRSP assets you aren't going to touch for 20+ years, VGRO with regular monthly contributions will get you further ahead than VBAL. The reason VBAL performance is similar to to VGRO over the last couple years is because of interest rate declines and excess return from the fixed income portion of the portfolio. Don't expect this to the be case moving forward, especially if/when interest rates start to increase to normal levels.This quote is hidden because you are ignoring this member. Show Quote

I totally agree with you about the emotional decisions comment - as others have said in this thread, the key is to get into something that you aren't going to bail on if it's down 20 or 30%. View the decline as opportunity, and increase your contributions during that period if you're able. If you're going to bail on any investment you have (VBAL, VGRO, or whatever the case is), you're just going to make investing wayyyyy harder than it needs to be.

There are some great, low cost funds out there. There are segments of the market where active management is MUCH better than indexing (corporate fixed income, small cap etc), but for most people looking for a one stop simple solution, something like VBAL, VGRO is perfectly fine, and will get you where you want to be.

Mawer is a FANTASTIC equity manager - one of the best, if not the best, in Canada. I've followed them, and used them regularly for over a decade. Fixed income management isn't their strength, but overall Mawer Balanced @ 0.91% is one of the best active management solutions out there. The beauty of Mawer Balanced is you get access to a few of their underlying strategies that are capped to new investment (Mawer New Canada (Canadian small cap) is one example).

Fair enough my friend, you make a good point. I'm just trying to save the OP some money and painful lessons lol.This quote is hidden because you are ignoring this member. Show Quote

Again. I like Mawer. Not a single EIT on their roster to fuck up the portfolio.

If you want a doom and gloom scenario, you could always do the Schiff.

Its not an imposssible scenario that a US dollar collapse would wipe out the entire stock market, or at least most of it.

Cocoa $11,000 per ton.

I don't like Schiff for his BTC views and so bullish in gold but everything he says is so fucken spot on, I'd highly recommend doing research and not talking to a bank advisor about what to invest into.This quote is hidden because you are ignoring this member. Show Quote

All those stocks are really over valued and are holding on by a thread right now IMO. (I could be wrong on this)

But from what I see and reading

Bubbles everywhere.

If anyone wants to tell you everything is okay since they profit from you investing in ETFS then so be it.Largest equity Bubble (Pension and buyback bubble)

Largest wave of retirees of all time (The pension crisis, where retirees own all the stocks and credit

The Corportate credible bubble (Where did stimulus money go?)

The student loan bubble (Mostly USA)

Auto loan bubble

Indexation bubble

ETF market structure bubble

Foreign borrowings bubble (Dollar standard bubble)

Tje Monetary policy bubble (As stated we in MP3 now)

The EU Banking bubble (Deutsche bank)

Peter Schiff also had a good one on Joe Rogan recently (I didn't listen to the one above yet)

Issue with him is he is so strongly for gold but again if everyone rushes into something it creates a bubble. (Not that i'm against gold)

Also Fed is trying to get inflation over 2% right now with the TRILLIONS injected but there is no inflation right now, could it be what Japan experienced in the 1990s? (I think that's when)

Please do research yourself with reading a shitton rather then taking the lazy way and asking someone who benefits from your investments.

Try to find people who have zero benefit from your actions and just explain the situation well and then you can make your own decisions.

Originally posted by beemerm3

so if we only seen 5 % of the oceans why not drain them or somethin lol or can u even transfer water from one ocean to another??? think of all the stuff u'd findtreasures n eerything.

Peter Schiff is just like everyone else... He talks his book.

Haha I know the asset allocation plays a significant role and that over the long term, in theory, VGRO should perform. Which is why I mentioned short term. The key point I was trying to make is the pain index an investor is willing to tolerate and how these things are marketed to the average investor. Yes sticking to a strategy is super easy in theory, but I would say a lot of people were making decisions in March this year that were detrimental to their overall portfolio, based on the volatility they experienced.This quote is hidden because you are ignoring this member. Show Quote

Also, have a look at some examples of how some passive 60/40 and 80/20 funds have done over a long time period. The annual rate of returns are quite similar. Again, the reason I point this out is someone more likely to bail on their investment portfolio if they are in a higher volatile portfolio.

Check out those 20 year annualized rate of returns.

https://cdn.canadiancouchpotato.com/...-ETFs-2019.pdf

As for funds and Mawer, again thatĀ’s the point IĀ’m trying to make. Funds get painted with this large brush of being shitty and brutal, yet that is not true at all.

These opinions are entirely my own and do not represent any other person or organization.

The one thing that noone is talking about is the ridonkulous price of lumber/pressure treated lumber. Literally 4x the price of March.

For a lot of people its a consumed commodity not unlike a cooked chicken. If a chicken was $8 in march and $32 now, people would be readying their guns. Work all day to be able to afford two fenceposts? We are there.

https://www.homedepot.ca/product/mic...ood/1000790733

Oil as a commodity? Dying a painful death from a demand and price standpoint.

Last edited by ZenOps; 08-30-2020 at 04:41 AM.

Cocoa $11,000 per ton.

Don't buy gold. Buy lumber.

If you want my crackpot theory: Buy wine. Right now there is a glut from the restaurants closing down. But the California wildfires are raging out of control and if they hit the valleys - it will take a lot of grapes with them. That, and the wine market is magnitude smaller than the silver market. Literally 0.1% Buffett type spending could shift wine. Will people actually be able to get an Argentinian or French wine if they slow or shut down the ports? Availability is a huge factor.

If Pepperoni is a high value item because of its difficulty to make, wine is right up there too. Although arguably, millenials and GenZ can't afford wine as is now.

https://www.usatoday.com/story/money...es/5595762002/

As far as metals go, nickel of course - because its hard to acquire.

https://www.androidauthority.com/how...trucks-111417/

Stocks? Psshh, all you get at the end of that are US dollars.

Last edited by ZenOps; 08-30-2020 at 09:04 AM.

Cocoa $11,000 per ton.