I agree and we are seeing it now for a few reasons in the housing markets.

1. 0% INTEREST Rates (well its 0.25% for bank lending rates) people can finally afford mortgages that they couldn't before, since the payments are now lower per month.

2. Fear of Inflation, people are now scared prices will never go down (Deflation) and it's better to buy it now than for more money afterwards.

We will always have inflation i guess said it wrong, but the fear now is of A LOT of inflation (10-100%) which i don't see happening in the long term because of cause and effect.

The government currently can't increase rates but they will, they will have to to reduce inflation that happens from money printing and the current inflation rates, when this happens it's going to be a different ball game IMO. They will have to increase rates sooner or later.

Yes 2% will trigger insolvencies, it will create tons of people who can't afford mortgages and companies who are whoever leveraged with debt will start to fail.

Which will in return cause a larger supply of homes on the markets causing prices to drop (More supply than Demand) and with interest rates going up it will not allow as many people to get that mortgage which will remove buyers because they won't be able to afford the mortgage as well..

All of this with overleveraged companies going under because of the increase in interest rates and removing more jobs creating even less Demand for mortgages.

If the government decides to keep rates at where they stand, it going to continue to create this inflation and people are going to struggle and reduce spending on things that are wants and only spend on "needs" (Food/shelter)

This is how I see it in the upcoming future, inflation will currently be short-term.

Again let's go back to why this is happening?

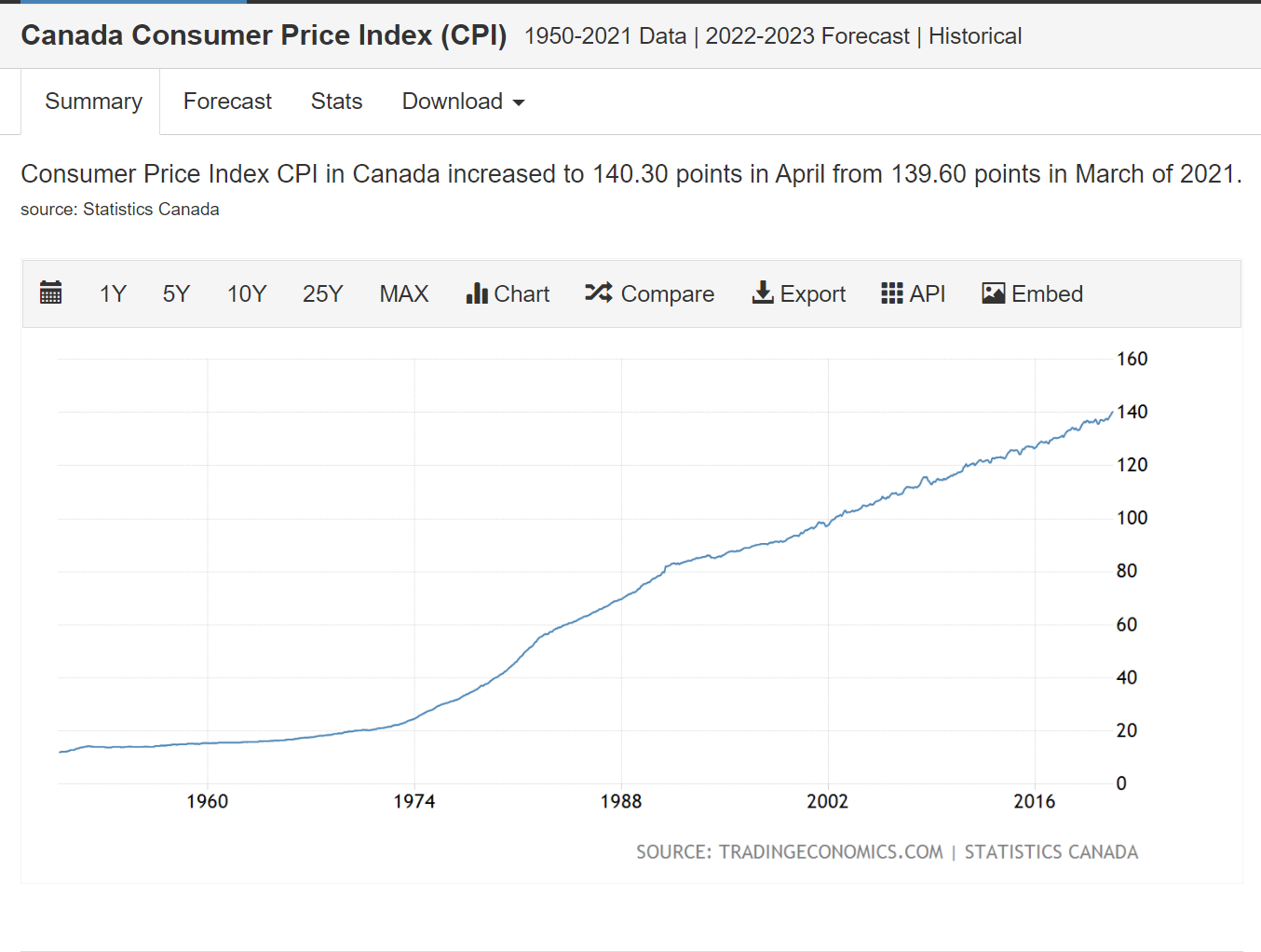

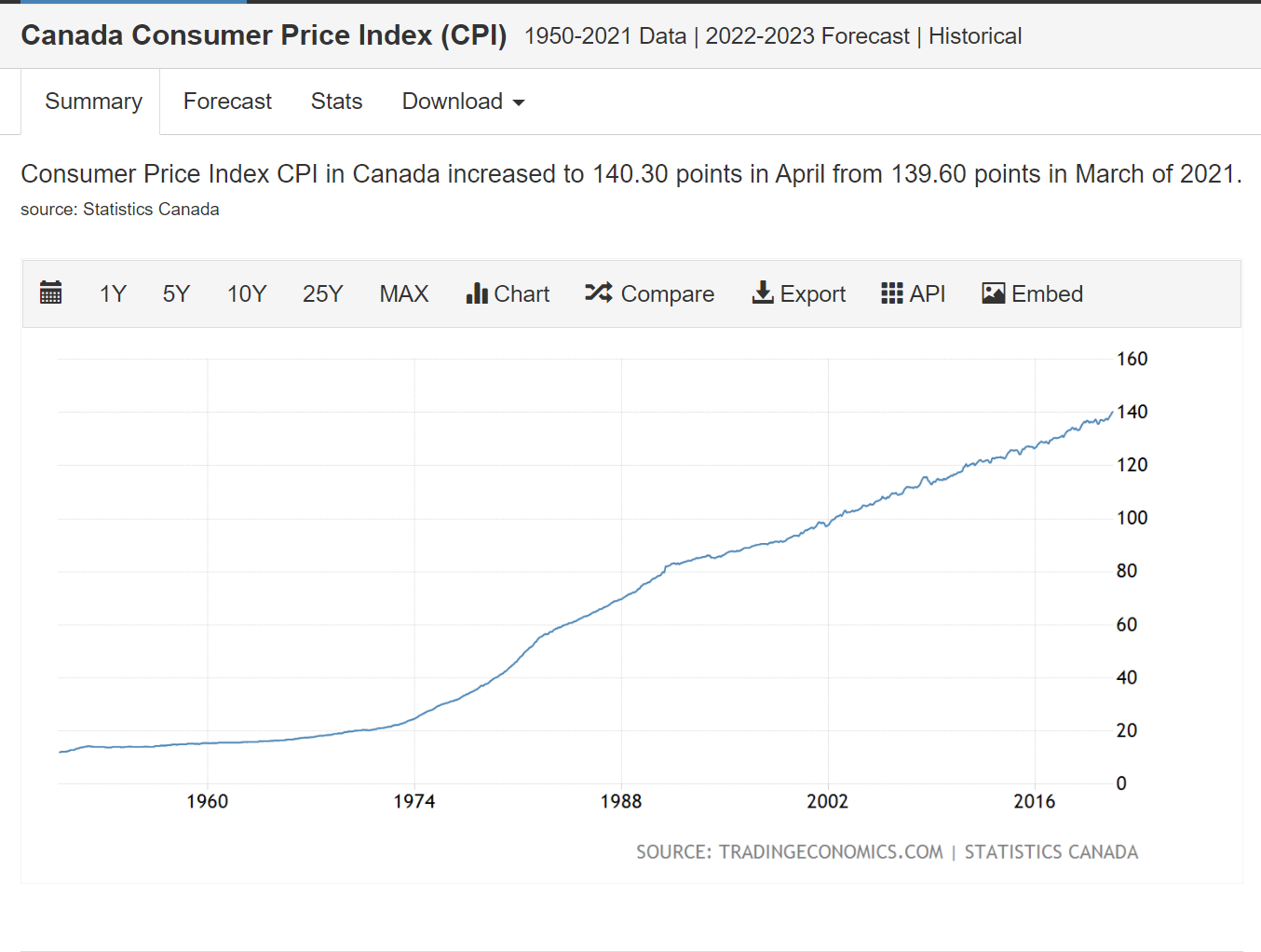

Lets look at CPI

» Click image for larger version

» Click image for larger version

We can see it starts to take off in the 1970s.

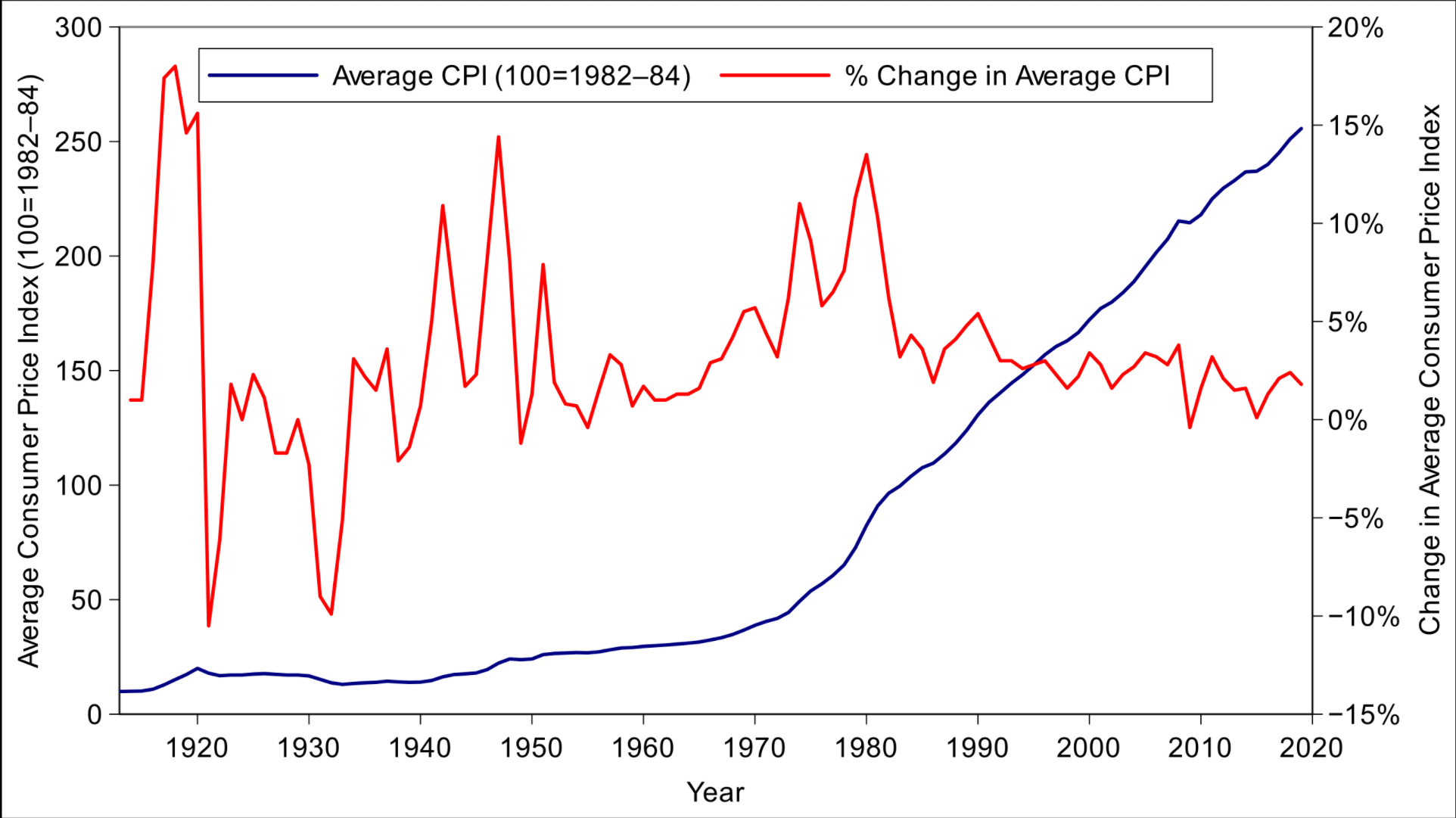

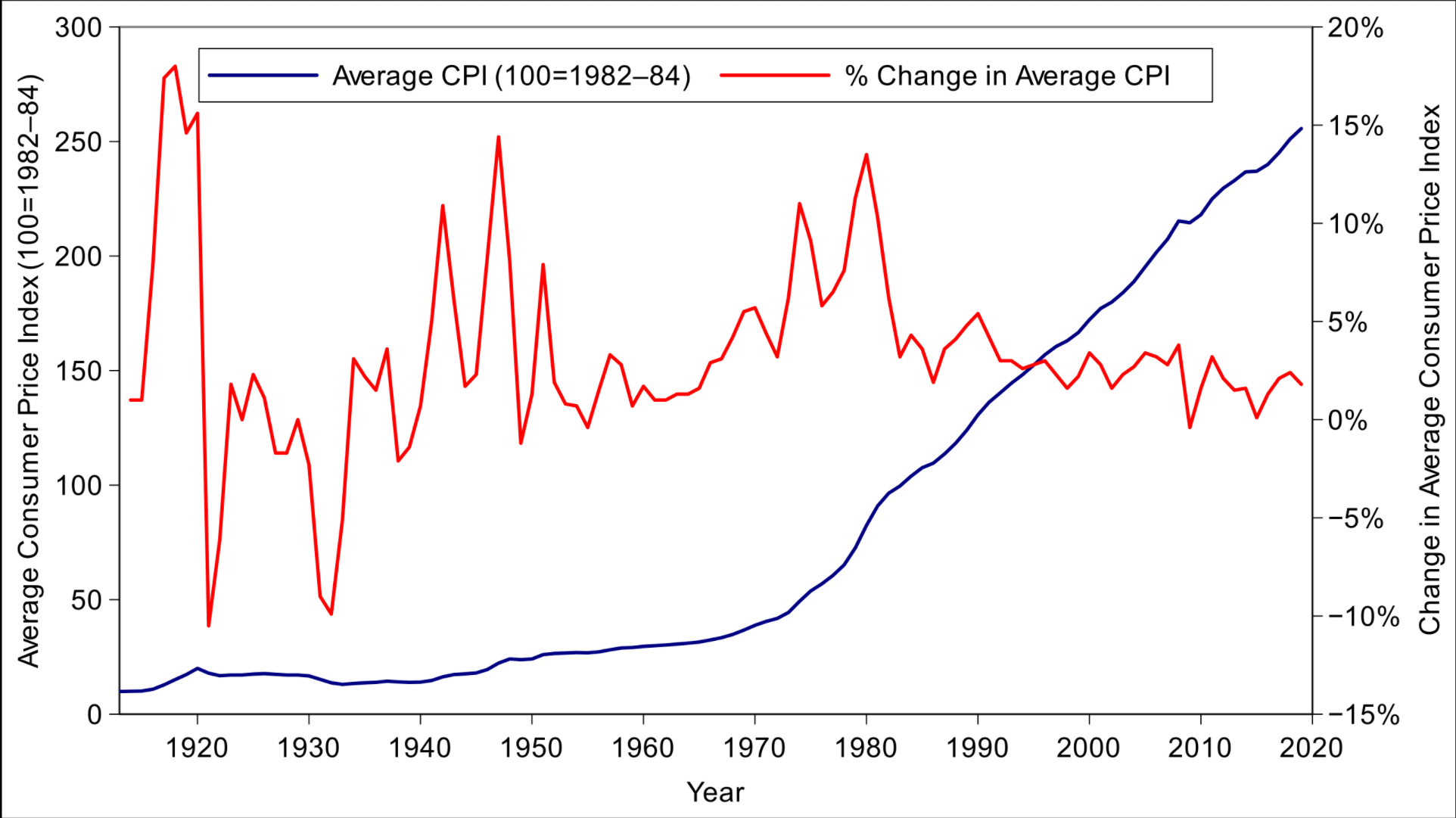

Now let's look at the last 100years

https://www.minneapolisfed.org/about...ce-index-1913-

1921 -10.9%

1930 -2.7%

1931 -7.9%

1933 - -5.2%

Only time in the last 50 years we had deflation was 2009 where it went -0.04%

» Click image for larger version

» Click image for larger version

We just have to look at it from a bigger perspective not just the last 20-40 years we have mostly all been around only.

And each one of those currencies is pegged to the USD, as is CAD, AUD and every other currency you can mention.

USD = WORLD Reserve Currency not NORTH AMERICA Reserve Currency.

This is very important to understand, if u want to buy goods in China you use the USD to purchase them.

CAD exchanged for USD

USD Used to purchase the goods.

USD Converted to YUAN.

This is every single transaction.

Quote

Quote

treasures n eerything.

treasures n eerything.