Haha Pretty much, except you forgot WISH and WEN and CLOV and probably a few others...This quote is hidden because you are ignoring this member. Show Quote

Haha Pretty much, except you forgot WISH and WEN and CLOV and probably a few others...This quote is hidden because you are ignoring this member. Show Quote

Bobby at this point you are buying lottery tickets, but I think you understand that better than most.

This quote is hidden because you are ignoring this member. Show Quote

Bob when it comes time to retire you basically liquidate things and put it all on black. If you hit it, enjoy your retirement. If you don't, just go back to work lol

Same general statement, although the market is and has been overpriced from a historical perspective for nearly a decade as the Central Banks pump it up so I wouldn't be rushing to invest any big lump sums in it hoping to cash a lottery ticket. Many will argue that "time in the market beats timing the market" and this is true ~66% of the time but if you're going to need the funds in 5-10 years I wouldn't take the gamble at the moment myself.This quote is hidden because you are ignoring this member. Show Quote

Investing in your business and house were probably the smartest thing to do provided those investments added value to each.

The nice thing with real estate gains is that they're "sticky" in that people don't tend to want to sell for less than they paid so tell estate doesn't usually decline as fast as the markets will (housing doesn't typically increase as quickly either but recent gains have been phenomenal due to the aforementioned Central Bank policy).

I'll add a post later with the emotion of the market cycle... While anything can certainly happen, markets feel a little euphoric at the moment and a lot of that is for the exact issue you've been having (traditional investing hasn't been working and people need to go further and further out the risk curve to make returns, including pumping up leverage). The thing with leverage is that when it unwinds, it can do so in a hurry!

Edit:

Note that I don't think the chart fully applies anymore as it seems Central Banks will always step in before the Panic/Capitulation/Anger stages and are willing to demonitize currency rather than let investors lose. They've made the Stock Market act like a Savings Account and thus it's inextricably linked to the economy now.

That still doesn't mean that it makes sense to make bets during the Thrill/Euphoria stages of the cycle.

Last edited by davidI; 06-13-2021 at 02:07 AM.

Sedar and Edgar. Duh.

The problem is people are hilarbad at picking where they are on that chart.This quote is hidden because you are ignoring this member. Show Quote

Originally posted by Thales of Miletus

If you think I have been trying to present myself as intellectually superior, then you truly are a dimwit.

Originally posted by Toma

fact.This quote is hidden because you are ignoring this member. Show Quote

I've definitely thought we've been moving from Optimism to Thrill for a while (i.e. when Davey Day Trader started using a scrabble bag) but every time a new stock picker asks me about investing or I overhear supermarket cashiers, flight attendants, and people by the swimming pool talking about investing/crypto, it's hard to think we're not in Thrill territory.This quote is hidden because you are ignoring this member. Show Quote

Sure. Maybe.

Originally posted by Thales of Miletus

If you think I have been trying to present myself as intellectually superior, then you truly are a dimwit.

Originally posted by Toma

fact.This quote is hidden because you are ignoring this member. Show Quote

Yep, maybe. I think it all depends on when the Fed sobers up enough to stop topping up the punch bowl given everyone is already wasted.This quote is hidden because you are ignoring this member. Show Quote

When and whether they will is above my class status.

Every central bank right now:This quote is hidden because you are ignoring this member. Show Quote

Have you guys heard of motley fool? I hear they can give great returns and investment advice. I’m going to subscribe to their service and put my savings there.

Saying this 'this time is different' is always dangerous. I have very little confidence in being to personally time the cycle. We all like to think we can but its nearly impossible in practice...and it hurts returns. US S&P has been around the same PE since 2015. I thought it was expensive then but have missed a lot of great returns by waiting. If we could logically arrive at an accurate conclusion on market cycles and our place in it we'd all be wealthy.This quote is hidden because you are ignoring this member. Show Quote

I think markets are reasonably priced today given a) historically low rates and b) big tech names having incredible market share/power with long runways for growth. US markets look expensive on ratios alone but they also have the biggest share of the most enduringly powerful and profitable companies in the world that you don't find in other indices. Yes there's pockets of mania like meme stocks and crap coin but its a relatively small pocket of the market that gets most of the news exposure. Overall markets are not expensive but not cheap either...perhaps a fair price.

Portfolio managers that have historically outperformed are also typically do bottoms up analysis and don't care a great deal about the macro environment. On fintwit where there's a surprisingly amount of great analysis and people are finding value left and right being overlooked.

There will be another crash at some point....could be this year could be in 10 years. When it happens it'll be a doozy because the fed is out of ammo when it comes to stimulating the economy because rates are so low. That's the other big risk - inflation getting out of control between pent up demand and endless stimulus. Terrible for most company valuations except for maybe banks and insurers. How it all plays out is anybody's guess...

Hard to protect against the downside while participating in the upside. It's something everyone struggles with. Being diversified and defensive feels like a loss when you hear stories of people getting 50% or better returns

This quote is hidden because you are ignoring this member. Show Quote

All noise. Just focus on yourself and your own goals.This quote is hidden because you are ignoring this member. Show Quote

For all the 50%+ gains, there are the closet cases who are down huge and don't know what to do. And it's killing them inside.

For every one that's up, there's 1000 that are down huge.

r/WSB has a ton of loss porn.

I have been lucky taking a couple shots at meme stocks the last bit. Nothing crazy just some light gambling fun. BB I made maybe $100 on 50 shares and right now I am up 15% on WISH with 75 shares bought at $10/USD. Watching the prices today closely and am hoping to get up to over $12 a share and then punk out and make a quick $150.This quote is hidden because you are ignoring this member. Show Quote

You should consider doing options, especially if you're playing with meme stocks. Ride the volatility if you want to gambleThis quote is hidden because you are ignoring this member. Show Quote

Didn't you just say this time is different?This quote is hidden because you are ignoring this member. Show Quote

I generally agree with you re: market timing but it's always going to depend on individual circumstances and timeframes and whether you're dealing with a lump sum or ongoing deposits.

The S&P 500 has 2x'd over the last 5 years... after things looked to be flattening/declining through Q2-Q4 in 2015. At the same time, had you invested in mid-2000 it would have taken until mid-2007 just to break even and had you not cashed out in the short window of new highs before the GFC, it would take until March 2013 to break even with your mid-2000 investment again. So basically, as long as your timeframe was 13+ years, you were all good. If you had to sell to account for unexpected expenses over that time, treasuries/bonds would have been far better.

For those with monthly income/deposits and a long investment horizion, I think it always makes sense to DCA. Just come up with your portfolio allocations and automate the monthly purchases. Easy as.

If you have a big lump sum deposit and the CAPE is as high as it currently is it's a bit of a coin flip...

https://www.evidenceinvestor.com/tag/elm-partners/Elm Partners provided some valuable insight into the question of whether investors should wait to buy equities because they believe valuations are too high. Looking back at 115 years of data, Elm asked: “During times when the market has been ‘expensive,’ what has been the average cost or benefit of waiting for a correction of 10% from the starting price level, rather than investing right away?” It defined “expensive” as the occasions when the stock market had a CAPE ratio more than one standard deviation above its historical average.

Elm noted that while the CAPE ratio for the U.S. market is currently hovering around two standard deviations above average, there aren’t enough equivalent periods in the historical record to construct a statistically significant data analysis. It then focused on a comparison over a three-year period, a length of time beyond which they felt an investor was unlikely to wait for the hoped-for correction. Following are its key findings:

— From a given “expensive” starting point, there was a 56% probability that the market had a 10% correction within three years, waiting for which would result in about a 10% return benefit versus having invested right away.

— In the 44% of cases where the correction doesn’t happen, there’s an average opportunity cost of about 30%—much greater than the average benefit.

— Putting these together, the mean expected cost of choosing to wait for a correction was about 8% versus investing right away.

Bold is mine as the current CAPE is 2+ SD above historic so take from that what you will. https://www.currentmarketvaluation.com/

For the majority of people's circumstances though, time in the market beats timing the market.

^^^

All fair points. Agreed that CAPE is way out of whack and tons of exuberance in pockets of the market. From I've found the overvaluations back in 2000 were wide spread whereas it seems most companies are reasonably priced especially given near zero rates. The big difference as you pointed out is the fed providing endless liquidity and buying up corporate bonds thru the pandemic. That was unprecedented and really alters how the market functions in terms of liquidity and perception of risk. Maybe the fed will backstop every dip til the earnings catch up or maybe it ends in disastrous inflation or somewhere in between. Just a really strange time to be investing.

There does seem to be reasonably priced or undervalued markets in emerging markets like Turkey but I think the saying goes emerging markets stay emerging markets for a reason.

Today's Fed announcement should be interesting... although I don't expect much to change in their position until August. It would be nice if they'd at least start talking about reducing their purchases of MBS and such.

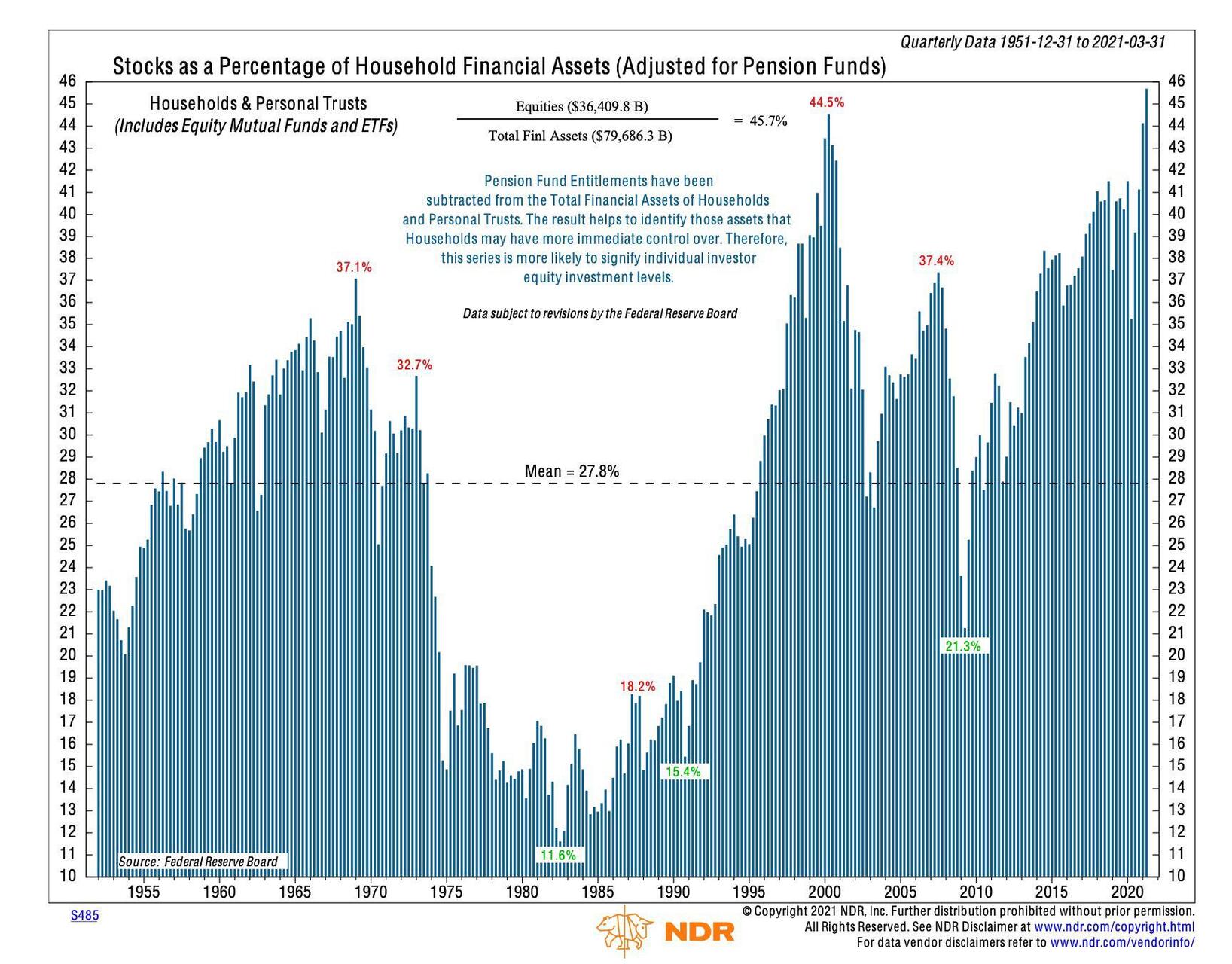

Another indicator of market manipulation... stocks have truly become the new household savings account.