Nationalize it, or blackrock rents it to us. Pick your poisonThis quote is hidden because you are ignoring this member. Show Quote

Nationalize it, or blackrock rents it to us. Pick your poisonThis quote is hidden because you are ignoring this member. Show Quote

Try not to accidently sell your home.

No one in Aspen is drinking pop. How do you think they got there? No pop, no avocado toast and definitely no streaming services. That's about 100k a year savings!This quote is hidden because you are ignoring this member. Show Quote

Ultracrepidarian

Some dealer out east is advertising 2023 Supra at invoice, is that deflation?This quote is hidden because you are ignoring this member. Show Quote

Is it going be cheaper in five years?

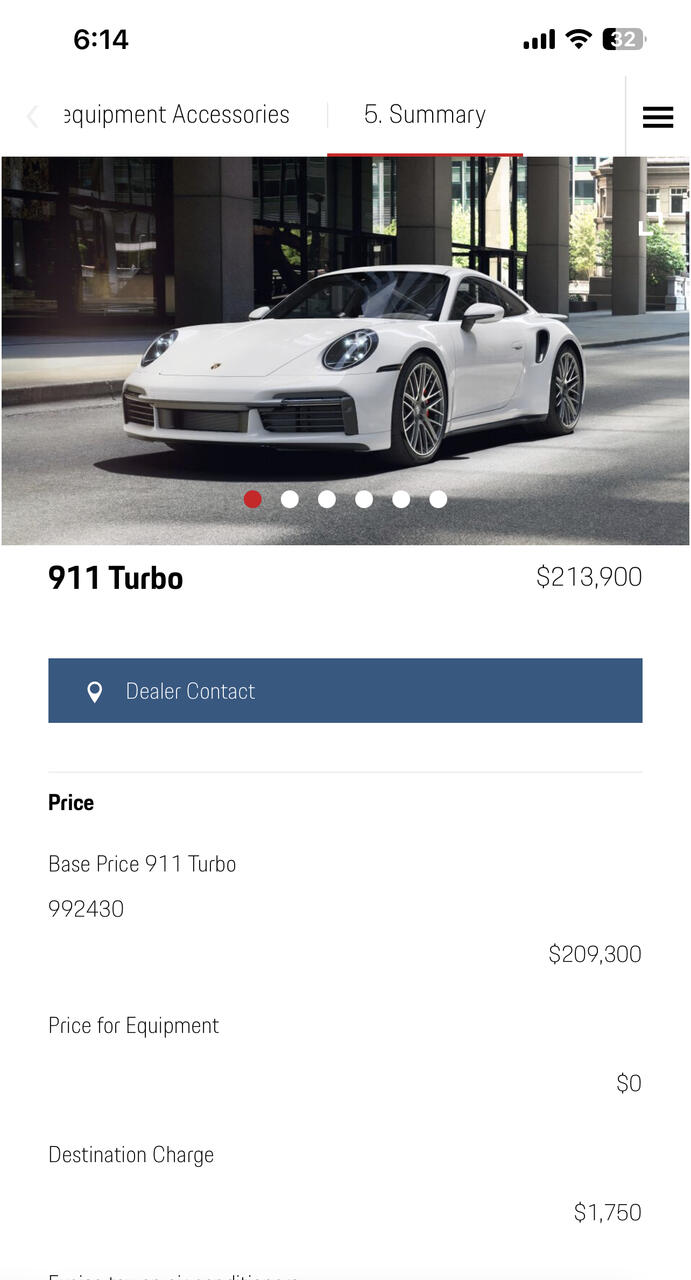

Supras that’s not good enough lol Lmk when 911s sell for msrp lol that’s my metric

I am user #49Originally posted by rage2

Shit, there's only 49 users here, I doubt we'll even break 100

This quote is hidden because you are ignoring this member. Show QuoteThe probability that interest rates would stay under 5% for the duration of your mortgage (25-30 years), is probably pretty low. Anticipating otherwise would be fairly silly in my mind and this has nothing to do with trying to predict the future.This quote is hidden because you are ignoring this member. Show Quote

911's are for wanna be car guys where things didn't quite work out the way they wanted. Stick with the NSX.This quote is hidden because you are ignoring this member. Show Quote

Last edited by 90_Shelby; 12-08-2022 at 06:46 PM.

I like neat cars.

Ahaha I’ll get laughed out of the showroom. Hello sir I wanna buy a new one like this zero options pls lol

I am user #49Originally posted by rage2

Shit, there's only 49 users here, I doubt we'll even break 100

A friend got a Supra under msrp here in Alberta a few weeks ago, but it’s an auto one.This quote is hidden because you are ignoring this member. Show Quote

Not sure if anyone has brought this up, but with the trillions of debt the US has, I thought it would be unstainable if interest rates remain too high. Their interest payment alone could exceed their GDP. Perhaps this is one reason why they rather be aggressive to curb inflation. Short term pain over long term, and wont even mind inducing a recession so they have a new reason to reduce the rates back down and prolong the inevitable. <-what ever that isThis quote is hidden because you are ignoring this member. Show Quote

_________

2019 IS350 AWD

20xx NX350 AWD

It's pretty difficult to accomplish a soft landing.

The USA is run by imbeciles at the moment, don't expect anything they do fiscally do make any sense.

They need buffer back to have something to control the next crisis.This quote is hidden because you are ignoring this member. Show Quote

And we have endless possibilities of what that will be.

In short term we are staring at another debt bubble.

In mid term (or could be short term) we are looking at petroyuan if Saudi is crazy enough to take it. Russia already accept payment 1/2 in yuan.

In long term, we are see demographic issue everywhere but Africa.

Last edited by Xtrema; 12-09-2022 at 09:27 AM.

they're worried about high interest rates, so they are raising interest rates?This quote is hidden because you are ignoring this member. Show Quote

One common misconception is thinking the federal debt (both Canada and US) tracks the federal reserve / BoC interest rates. Majority of the federal debt is in bonds which at the moment are starting to drop but moreso they are often locked up for long periods of time.This quote is hidden because you are ignoring this member. Show Quote

Canada for example took a lot of its Covid debt as 20+ year bonds at very low interest rates. So we wonít see the increased interest costs for quite some time. However Ö that day will come and itís going to be very ugly.

~450 billion of Canadas 1.1 trillion is locked until past 2030. 100B is locked until past 2050.

https://www.bankofcanada.ca/stats/go...022_11_30.html

Last edited by pheoxs; 12-09-2022 at 09:35 AM.

Bonds are traded on the open market, they don't behave like your mortgage.This quote is hidden because you are ignoring this member. Show Quote

lol stop thinking the yuan is going to be anything.This quote is hidden because you are ignoring this member. Show Quote

they are but the coupon rate doesn’t change until they expire. If Canada issues a 2% 25 year bond during Covid it doesn’t matter if you buy it then sell it to me then I sell it to rage. Canada still pays the same 2% for 25 years.This quote is hidden because you are ignoring this member. Show Quote

and what determines the pricing on the next set of GoC bonds?This quote is hidden because you are ignoring this member. Show Quote

Magic.

pheoxs is correct, but governments are constantly renewing debt. That's the problem.

It also means that tactics like QE are basically impossible to do now.

Just as an fyi, a bond that pays 8% was basically considered to be junk (i.e. there was a very high chance the debtor would not last the term of the bond) before all this happened.

Last edited by suntan; 12-09-2022 at 09:48 AM.

He's not really correct, no - at least not in any useful sense....the nominal/coupon rate of the bond is only one piece of the puzzle.This quote is hidden because you are ignoring this member. Show Quote