how's the working out?This quote is hidden because you are ignoring this member. Show Quote

how's the working out?This quote is hidden because you are ignoring this member. Show Quote

If only grade schools focused on financial literacy and adulting rather than gender cult indoctrination, we wouldn’t be in this disaster.

That's a good start. But nothing will change as long as the gov't and central banks continue trying to manage the price of capital (monetary and fiscal policy), and the price of risk (CMHC).This quote is hidden because you are ignoring this member. Show Quote

I could see things getting dicey when the millions of mortgages currently on low fixed rates are up for renewal in the next couple of years with rates basically double what they're used to.

That is exactly the position I am in. I have a low fixed rate and hoping in the next few years rates aren't completely a mess and really throw me for a loop.This quote is hidden because you are ignoring this member. Show Quote

Have we experienced this acceleration in rate increases in recent history?

My rough calcs of affordability are based off of rates doubling within the 5 year term. Tripling would be new territory

Ultracrepidarian

Pay down principle as much as you can before then. Probably better move than parking money in stonks when it comes time for renewal.This quote is hidden because you are ignoring this member. Show Quote

53% buyers were on variable and already felt the hit. Portion of remaining 40 odd percent fixed already got rude awakening last 15 months. So my guess it only 1/3 mortgage left to feel the increase over the next 3 years. Should be manageable if lender is trying to keep people in their homes.This quote is hidden because you are ignoring this member. Show Quote

6.9% of 87 to 13+% of 90?This quote is hidden because you are ignoring this member. Show Quote

vs

0.25% of 21 to 4.75 of 23?

Don't know if history is repeating itself but I remembered RE was awesome until 91 then Calgary run into bust cycle til 96/97.

Last edited by Xtrema; 06-20-2023 at 10:02 AM.

This is almost my exact scenario.This quote is hidden because you are ignoring this member. Show Quote

Bought a "cheap" starter house in 2018. Signed a fixed payment variable at prime - 1.0 at 3.46% at the time(effectively 2.46%) 360k on a 25y mortgage

Rode lower interest rates all through covid and made out pretty well, only the last year hasnt been favorable.

Edit: Back calculating, my remaining principle is about 10-12k lower having picked the variable compared to signing a 5 year fixed at the time

Just renewed a fixed 4.89% for 4 years, 295k remaining. Talked to 3 different lenders, all 3 of them initially pointed to the fact they would have to put me back to a 25 year.

I had to specifically ask to be put back on a 20y am. Felt greasy, but I'm sure 70-80% of their clientele is looking to keep their payments the same.

Payments increased from ~800 advanced b/w to ~970. an increase of ~340/m. Not painful since we live somewhat frugally and actually save quite a bit, but i can see it stretching the pockets of others. I am not "beyond balling" by any means though.

Last edited by GT.....O?; 06-20-2023 at 02:37 PM.

"Speed has never killed anyone, suddenly becoming stationary… That’s what gets you."

Yes, its called marriage.This quote is hidden because you are ignoring this member. Show Quote

Kidding. On a serious note.

Rates 20 years ago were in the 8%(ish) range in the UK. I'm not a mortgage expert, but I always tell people focus on that range. The extra money you have either put down on principle or do something else productive with it. This is particularly useful to new immigrants who have no history or knowledge of this.

I just switched to a two year fixed(I had two years remaining on my variable). It was only slightly less than the variable I was on. Its not always about the rate but about ones financial goals and how one has structured the mortgage. Focus on the goal then figure on a financial plan to meet that. You can't control anything outside of that. Buster is spot on with his comment that the average person does not have more information than the markets.

I think people get to transfixed on interest rates like credit scores. It does not mean anything if one does not factor in other variables.

Where did you find that stat? I've always thought fixed was far more popular than variable in Canada...This quote is hidden because you are ignoring this member. Show Quote

"The share of variable-rate mortgages grew to about a third of all mortgage debt, according to the Bank of Canada, up from 20 per cent at the end of 2019."

https://financialpost.com/news/canad...nd%20of%202019

Yeah that's the same ratio I saw in one of the statements from the Bank of Canada. About 1 million mortgages up for renewal in 2023 and of those more than two thirds are fixed rate mortgages.This quote is hidden because you are ignoring this member. Show Quote

If true. Soft landing not achievable.

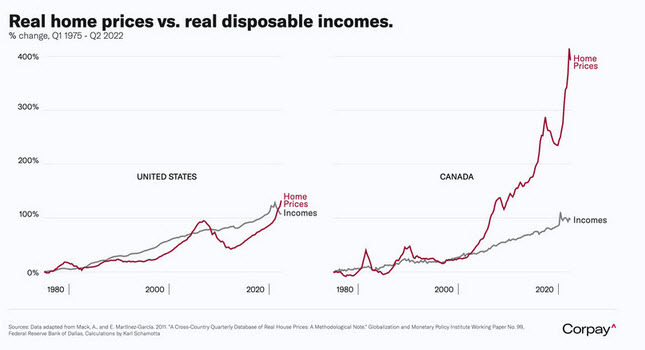

I would love s0pome granularity on that chart, or rather, that same chart for Calgary urban area only. Bet it's not nearly as stark.

This quote is hidden because you are ignoring this member. Show Quote

Those are 2021 numbers. Fixed is now the majority after 1 year or so of renewal.This quote is hidden because you are ignoring this member. Show Quote

EDIT:

https://www.mpamag.com/ca/mortgage-i...riable%20rates.That saw the share of mortgages on variable rates in Canada peak at 56.9% at the beginning of 2022 – just before the Bank set off on a series of rate hikes that has spiked its policy rate by 4.25 percentage points and brought a swift end to the outsized popularity of variable rates.

Looks like it peaked at 56.9% before the huge rate increase.

Last edited by Xtrema; 06-21-2023 at 12:17 PM.

how did this happenThis quote is hidden because you are ignoring this member. Show Quote

didn't we ban foreign buyers

where the hell is all this money coming from

real estate is best asset class

how much is sugarphreak's house now

I am user #49Originally posted by rage2

Shit, there's only 49 users here, I doubt we'll even break 100

You can only gamble for so many hours at a BC casino before your need to sleep, so you cash out and buy a mega mansion.

This guy had some of his followers show screenshots of some crazy mortgage amortizations.

https://youtu.be/iCOn7QQJo5I

Whole Lee Sheet! I had no idea that's how fixed payment / variable interest worked...lol. RIP to anyone that signed up for that.This quote is hidden because you are ignoring this member. Show Quote

"Masked Bandit is a gateway drug for frugal spending." - Unknown303

It shouldn’t be… payment should increase once you trigger 100% interest payments but the banks will bankThis quote is hidden because you are ignoring this member. Show Quote